Did you know you can get the Sprott Money Weekly Wrap Ups, Ask The Expert,

special promotions and insightful blog posts sent right to your inbox?

Sign up to the Sprott Money Newsletter here.

The Fed went ahead and did it. The Fed’s Policy Error has indeed cometh. The yield curve is already inverting.

This virtually guarantees a recession or depression. The beginning of the end of the bull market in stocks and real estate has begun, and the dawn has come for the pending bubble in precious metals.

I just did this search on Twitter: "@globalprotrader policy error", and I have been warning about this consistently since July 2021.

From August 6:

We got the expected drop in stocks, now we're seeing a bounce on "sell the rumor, buy the fact", but I don't believe we've seen the low yet. I said in my 2022 forecasts posted in December that stocks would be flat for the year. The Fed’s actions yesterday reinforce that expectation, imho, unless they reverse course sooner than anticipated. When they do reverse course, we’ll get a final melt-up in stocks prior to the total collapse of everything. This is most likely to occur next year—latest 2024, in my opinion. The WEF’s risk survey reinforces this expectation, calling for an “Asset Bubble Burst” some time between 2023 to 2025.

What does all this mean for Gold and Silver? The sky is the limit.

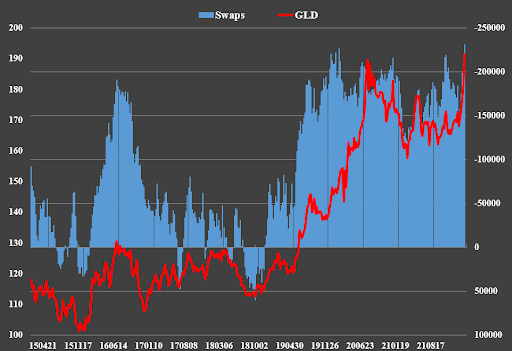

Timeframes matter. With the Banks record short, the risk is that we head lower first, either straight down or following a negatively divergent record high. I would lean more to the latter if it plays out because everyone and their dog will be bullish metals and miners at that point.

Looking to invest in physical gold? Check out our collection of gold bars and coins here.

Alternatively, the bottom is in for the complex and we’re going straight up to record highs, above 2300+ in Gold and perhaps even 50 in Silver.

I can already hear the naysayers commenting on how I’m stating the obvious: “Gold can go up or down! Great insight!” (Sarcasm intended.) But as I’ve said before, I’ll share the roadmap to determine which one is coming to fruition.

-

Straight down: Break of 1900.

-

Negatively divergent higher high, then down: Break 2089, or more importantly, close above 2069, then we fall back below those levels within days, followed by a break below 1900.

-

Straight up: Break 2089 and close above 2069, then continue up to 2100 plus and beyond.

As I shared above, my preference is for a negatively divergent higher high then lower due to the record short position held by the Bullion Banks and the extreme overbought and bullish conditions at new record highs. This will be like taking candy from a baby for the Bullion Banks. The temptation to squeeze out all of the weak longs would likely be too great.

That said, I won’t be shorting metals or miners. As I’ve been doing since December, I’ll be buying any and all material dips because the inevitable march higher to new record highs is coming, imho. Any pullbacks, no matter how big, will just be a detour before the rocket launch. Different route, same destination.

The glory days of new record highs in the stock market and home prices rising 20, 30, 50% per year are coming to an end. The bubble in precious metals is about to begin, and it will last for decades, imho.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.