Precious Metals Miners Setting Up For A Breakout Rally – Wait For Confirmation

Did you know you can get the Sprott Money Weekly Wrap Ups, Ask The Expert,

special promotions and insightful blog posts sent right to your inbox?

Sign up to the Sprott Money Newsletter here.

Precious Metals have continued to slide sideways as the US stock markets have rallied into the FOMC meeting last week. Not by coincidence, metals have continued to base/bottom near recent lows as concerns about the global debt/credit markets, central banks, and precious metal supplies continue to linger. The US Fed indicated it will do whatever is necessary to support the recovering economy. The question my research team asks in relation to the basis for a move in metals/miners is “do the global markets believe the global central banks still have control of the underlying global banking/credit markets well enough to prevent another massive rally in metals?”.

This question should be first and foremost for precious metals enthusiasts. Recently, there has been quite a bit of concern related to a Silver Squeeze and COMEX deliveries. Currently, there is some speculation that the Perth Mint has a very limited supply of physical metals on hand and nearly 60x that amount on their balance sheets (Source: https://www.reddit.com/r/Wallstreetsilver/comments/mc18no/perth_mint_unallocated_silver_is_not_backed_by/). We're no expert related to this lack of physical inventory, but if it is true, then a breakout rally in metals (a true metals SQUEEZE) could be just days or weeks away.

Wait For Confirmation Of Miners Bullish Breakout

The charts we are including in this article suggest “Wait For Breakout Confirmation” because we believe the current technical/price setup may prompt a bit of an extended bottoming formation. If and when the breakout in miners happens, the upside price move could be very quick and efficient.

The Weekly NUGT chart, below, shows how well price has consolidated near the $51 level and how the extended downside trend line (originating from the 2016 peak) aligns with the current price level. Our researchers believe once this trend line is breached to the upside, NUGT may attempt a rally to levels above $108, the 0.618 Fibonacci Price Extension level, fairly quickly (possibly within 3 to 6+ months). The $146 target level, a full 100% Fibonacci measured move, would represent a massive +167% price rally in NUGT (if it happens). Quite literally, this breakout setup could be very explosive if and when it happens.

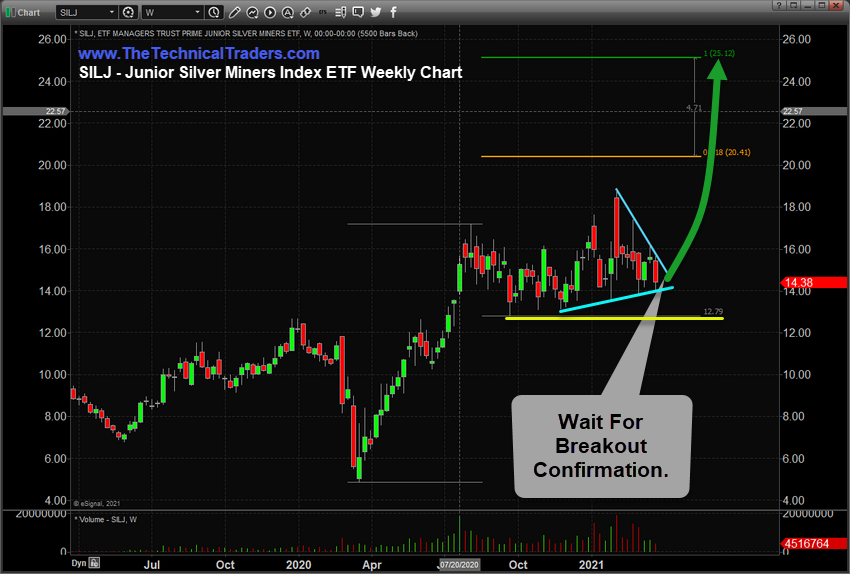

Junior Silver Miners Showing Stronger Support – Waiting For Breakout Confirmation

The following Weekly SILJ Junior Silver Miners chart shows a different type of price setup. Junior Silver Miners have held up much stronger than Gold Miners over the past 6 months. The reported Silver Squeeze could prompt a really big breakout trend IF and WHEN the current Pennant/Flag formation completes (which appears to be only a few weeks away).

The first (0.618) Fibonacci target is near $20.50 – a 40% increase from current price levels. The second target, a100% Fibonacci measured move, is near $25.25 – a 74% increase from current price levels. Ideally, this type of breakout move in Metals Miners will happen as a pause in the upward movement of the US Dollar takes place.

I believe the US stock market will continue to rally 4% to 8%, or more, over the next (3 to 5+) few weeks. After that, we may start to see more weakness in the US stock market and the price trends leading up to this period of weakness is where we think Metals and Miners may start to rally.

Again, we need to wait for confirmation of these breakout moves. The technical/price setup we are seeing in both NUGT and SILJ suggests a potential breakout move may happen within the next 2 to 5+ weeks. There could be a deeper downside price move, a washout price low, that happens as the APEX of this move completes. It is not uncommon for a “washout” trend to happen near a Flag/Pennant APEX.

Overall, the next few weeks in the markets suggest we are likely to see fairly big sector trends and moderately strong support for Metals and Miners. The strength of the US Dollar will likely keep metals from attempting any type of breakout move for a few more weeks. When the Metals/Miners breakout move starts, though, it could be VERY EXPLOSIVE.

Have a great weekend!

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.