Did you know you can get the Sprott Money Monthly Wrap Ups, Ask The Expert,

special promotions and insightful blog posts sent right to your inbox?

Sign up to the Sprott Money Newsletter here.

The Bullion Banks continue to cut their shorts in Gold, and the Funds are paring their longs too. Commercials are back to positions consistent with all of the prior lows in the past 18 months.

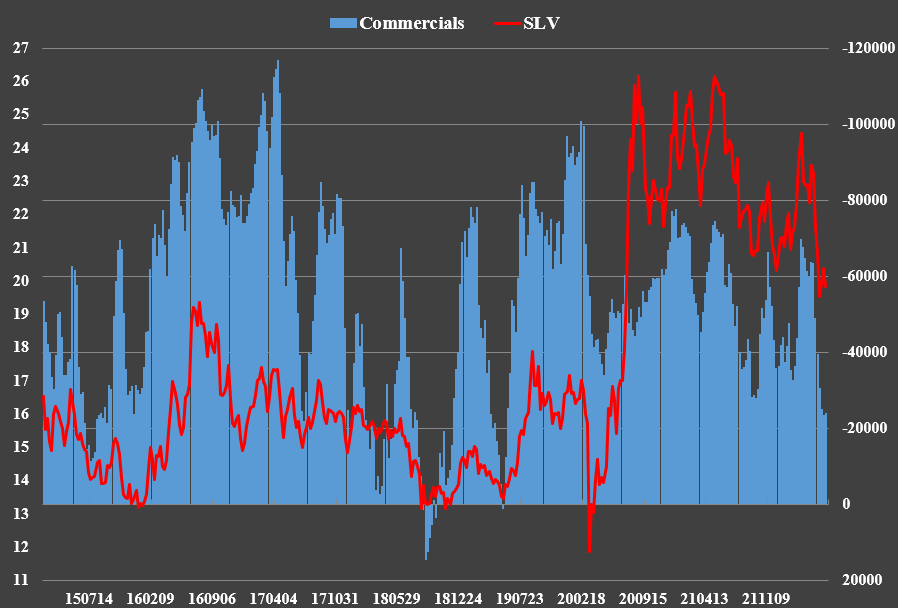

Commercials also have their lowest net short position in Silver since June 2019.

While this does not signal the low is in place just yet, it does say that it’s close.

The markets got a little concerned about a hawkish ECB ahead of their meeting today, but as expected, it was a “buy the rumor, sell the fact” event. The ECB was less hawkish than expected, citing the need for more QE to support the bond prices of peripheral countries such as Italy and Greece. The EUR dumped on the news and the DXY rose, putting pressure on the metals and miners. The risk of one more higher high in DXY remains before it dumps when the Fed reverses course (or before).

Regarding the Fed’s next 180, we get the CPI data tomorrow:

The headline CPI is expected to remain flat at 8.3%, and the core CPI, excluding soaring energy prices, is forecast to fall again to 5.9%. While this is not sufficient to throw in the towel on rate hikes and QT, signs that the economy is already in recession and the job market is not as robust as we’re being told bring the inevitable policy reversal closer.

‘Jobless Claims Jump Most Since Last July, Hit 5 Month High’

How can I say it’s inevitable? For many reasons, but this is the latest:

‘The US Economy, Including Jobs, Collapsed in May,’ as did Federal tax collections, according to Lee Adler at liquiditytrader.com.

If Lee is right, and it sure looks like he is, the Fed 180 will come sooner rather than later as deficits soar. Who's going to buy the new Treasuries being issued to fund the deficits and the maturing bonds? The ECB and BoJ already have their own problems.

Again, I believe it occurs by September or October this year at the latest, but likely sooner.

So how much lower could we go ahead of that?

GOLD

Anywhere below the prior low of 1785 would suffice as long as we stay above the bottom trendline in red at around 1740. By contrast, a break back above 1880 could signal the bottom is already in place.

SILVER

Anywhere below the prior low of 20.42 but above 18. A close above 22.50 would suggest the bottom is in.

GDX

A sustained break above 33.50 would negate the downside potential, but ideally, a drop below 29.66 and above 28.40 would set us up for the big rally to follow.

SILJ

A move back above 12.20, but more importantly, a close above the 200-day moving average would confirm that the bottom is in, imho. But a drop below 10 and above 8 ahead of that would truly create the fuel for the massive rally to follow.

In summary, the stars are aligning for Gold, Silver, and the miners, much like in Q4 2015, but we’re not out of the woods just yet. For those of you who don’t want to risk catching a falling knife, wait for a break of the resistance levels I cited before buying. The key unknown is the timing, but it’s months at most, imho.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.