Just last week, the spot and COMEX price for gold broke out of its recent trading range and surged to new all-time highs. However, to the frustration of many, the spot and COMEX price for silver remains well below its highs of last May. What's the deal? The answer may be found in the recent Commitment of Traders data.

Analysis of price trends for the COMEX metals involves myriad variables. One of those variables to consider is the current structure of the CFTC-issued Commitment of Traders report. Historically, a smallish Speculator net long position and a smallish Commercial net short position can clear the way for a price rally. Conversely, an overextended and large Speculator net long position often precedes a selloff and pullback in price.

Why Buy Silver: COMEX Silver's Underperformance

At present, prices of both COMEX metals are rallying. Off the recent lows of three weeks ago, the price of COMEX gold has rallied $150 or about 6%. Over the same period, the price of COMEX silver has risen $3 or about 11%. Not too shabby. However, as mentioned above, this latest rally has broken gold from its recent range and moved price into new all-time high territory. COMEX silver, on the other hand, is not even back to the highs seen last May.

Silver's recent underperformance versus gold can be blamed on several factors, including a drag from COMEX copper, which is down about $1/pound or nearly 20% from its mid-May highs.

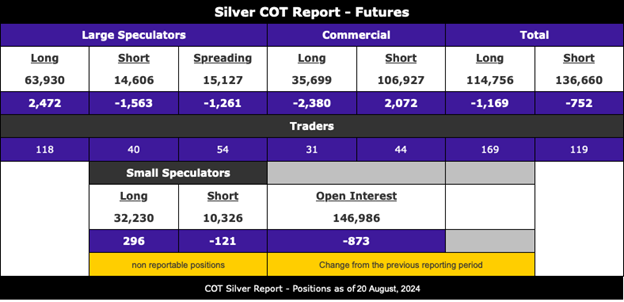

But let's take a look at that Commitment of Traders report we mentioned earlier. The most recent one is posted below, and you should be sure to note the gross short position of the Large Speculator category. At just 14,606 contracts, that summary position is very small by historical standards.

And why does that Large Speculator gross short position matter? Because as the late Ted Butler used to say, the Large Speculator and hedge fund short position is "rocket fuel" for rallies. Why is that? Because as hedge funds flip from a net short bias to a net long bias, that trade actually involves two buys: one buy order to cover the short and a second buy order to initiate the new long. In a tiny market like COMEX silver, that amount of buy volume can have a dramatic impact on price.

At present, however, the Large Speculator gross short position is very small and maybe half of what it could or should be. This leaves very little remaining Speculator short covering to be done, thus removing some of the buying pressure needed to take price back to $33.

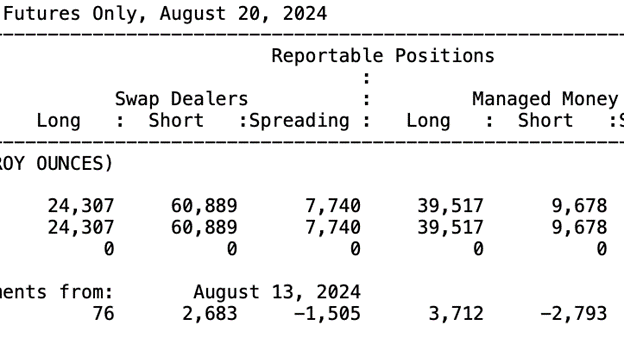

You can see this on the "disaggregated" Commitment of Traders report too. On this report, the "Large Speculator" category is divided into smaller components, one of which is labeled "Hedge Funds". Again, actively traded hedge funds are apt to flip from short to long due to technical factors and other indicators. But as you can see below, the remaining gross short position of these funds is just a paltry 9,678 contracts.

So, again, without that "rocket fuel" of Speculator short covering, COMEX silver can still move higher, but just not at a quick or frantic pace. As such, COMEX gold has broken out of its range, but COMEX silver lacks, for now, the inertia to break out of its own.

One last way to measure all of this is via a tool we've used at TF Metals Report for the past 15 years. I like to call it the "Large Spec Net Long Ratio". To calculate the ratio is simple. Just take the Large Speculator gross long position and divide it by the gross short position. Using the data posted above, that makes the ratio:

- 63,930 divided by 14,606 = 4.38:1

Commitment of Traders Ratio: What It Means for Those Looking to Buy Silver

Over the past 15 years, I've noticed that a ratio of 2:1 or less indicates a "washed" or "clean" Commitment of Traders report from which a price rally might soon develop. A ratio of 3:1 or 4:1 signals that the current rally may be getting long in the tooth. Anything above 5:1 or, rarely, 6:1 has almost always preceded a sharp price pullback.

Again, where was that ratio as of last Tuesday, the 20th, when the most recent report was surveyed? 4.38.1. To me, this overbought indicator is another reason as to why the silver price is failing to keep up with the gold price.

In conclusion, the silver price may continue to lag the gold price for a while longer. As it has always been, price rallies on COMEX will continue to unfold in a two-steps-forward-and-one-step-back pattern, and the COMEX silver market may need a little less bullishness—or a little more bearishness—before it is ready to extend higher and finally move to follow gold in its breakout.

Stay informed and consider buying silver before the next market shift—position yourself ahead of the curve in this volatile market.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.