Did you know you can get the Sprott Money Monthly Wrap Ups, Ask The Expert,

special promotions and insightful blog posts sent right to your inbox?

Sign up to the Sprott Money Newsletter here.

Initially aided by weaker-than-expected payrolls and both the CPI and PPI following suit, Silver and crypto miners led the way higher as the DXY slid below 100. The DXY may also be plagued by reports out of China and Russia that they will be launching a Gold-pegged BRICS currency on August 22, and this would be a direct attack on the hegemony of the dollar. However you slice it, a statement was made that certainly suggests the bottom is in for both monetary metals and miners. But nothing goes up in a straight line, and this appears to be a classic case of “too far, too fast”. Moreover, what if nothing happens on August 22? My point is there will be dips along the way in this volatile market. Let me stress this: I don’t recommend shorting to take advantage of those pullbacks, but I do plan to buy those dips. Keep an eye on the DXY.

DXY

The DXY is undergoing a classic A-B-C correction from its peak at 114 and has now broken below 100. It is extreme oversold on the RSI, but the MACD Line in blue allows for much further downside. My target for the low is ~92. Bounces aside in the DXY, this signals a massive rally in metals and miners ahead.

SILVER

Silver blasted through resistance and now only the peak of 26.23 on May 4 is in the way of a test of 30 next. Although the RSI is approaching overbought levels, the MACD Line in magenta says there is plenty of room to go higher. The weekly RSI is at 58, which also supports further gains to come. Support is now at 24.30-40, former resistance.

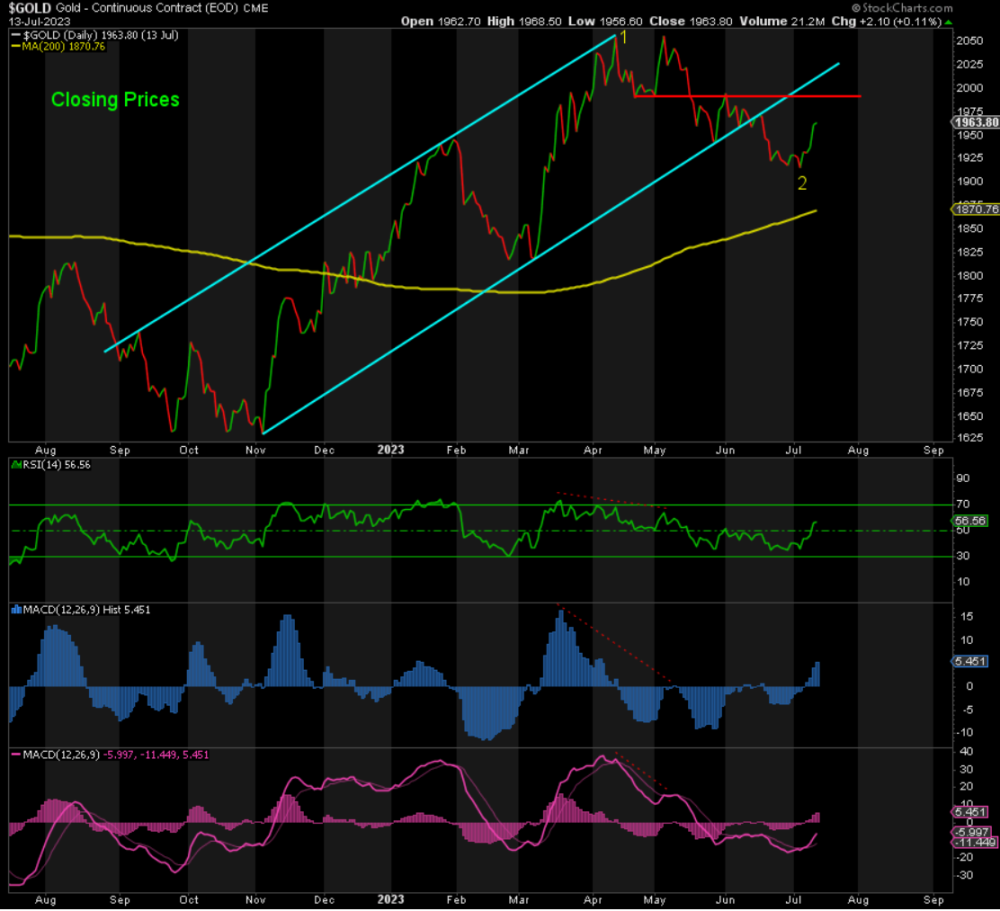

GOLD

Gold is the laggard. It appears to be capped around 1965 right now. It needs to get back above 2000 to set the stage for an assault on the record high to follow. Support remains at 1900.

GDX

Only three waves up so far, which is corrective. GDX still needs to close the gap to 32.50. Once above there, the prior highs around ~36 are a magnet. However, should it fall back below 30, which is highly unlikely at this time, then a lower low is back on the table. The MACD Line in magenta says different: it says we’re going much higher.

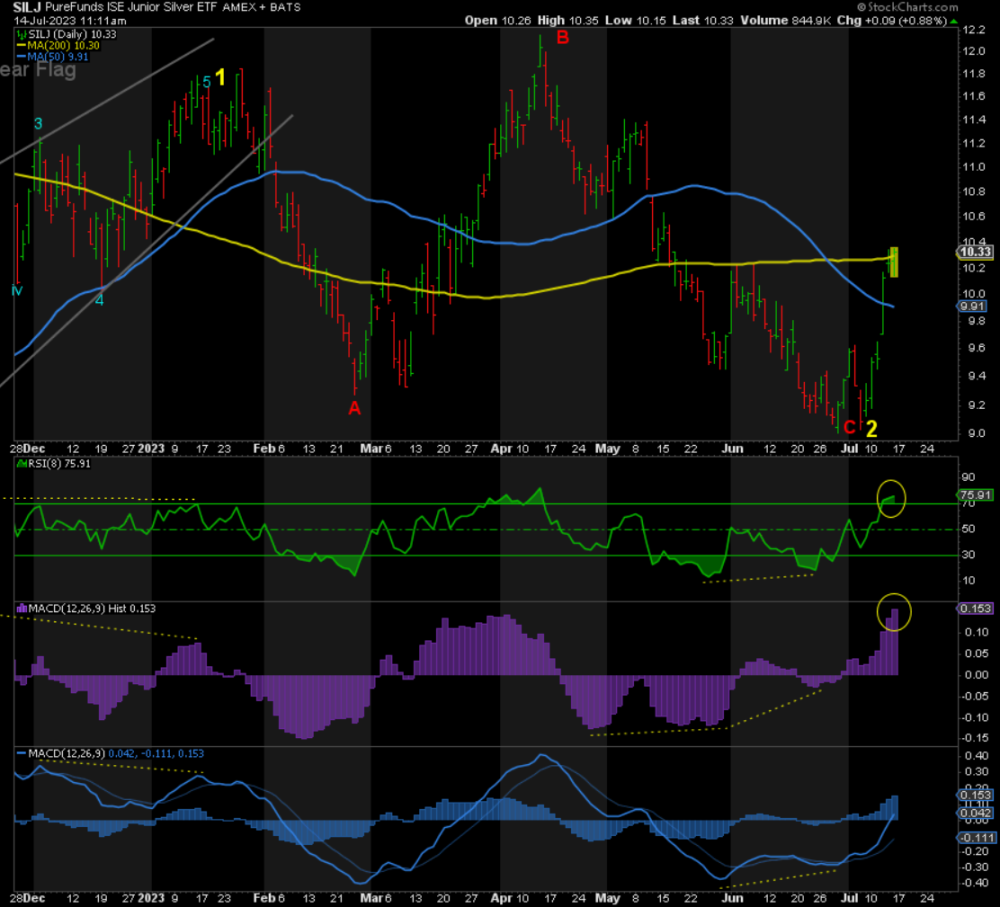

SILJ

SILJ has broken the prior double top of 10.23. It has also broken the 200-Day Moving Average. But the RSI and the MACD Histogram are extreme overbought, which suggests a short-term pullback. The fact that we have only three waves up off the low at ~9 also signals a fourth wave reversal before higher again. Saving the best for last, the MACD Line in blue is only looking up, short-term pullbacks aside.

CONCLUSION

While the metals and miners have spiked higher, aided by the dump in the dollar, they appear to be ready for at least a short-term reversal. Should we get any pullbacks, I will be buying those dips, especially if we take out 2000 in Gold. My stops are below 1890 in Gold.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.