This article explores the current market trends of gold and silver amidst uncertain economic data. Discover the potential impacts on precious metals and get insights on the market outlook.

The Interplay Between Economic Data and the Outlook for Precious Metals

It appears that economic data is not what it once was. Back on July 5, I posted this tweet:

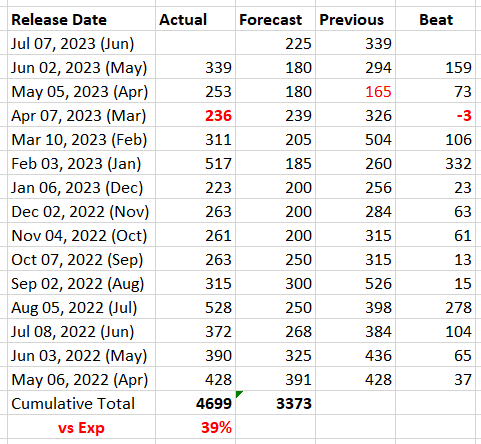

Here is the actual data:

My point was, how could employment data consistently beat forecasts and exceed those expectations by a cumulative 39%, given the deteriorating state of the economy?

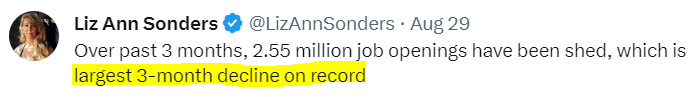

Now we get this:

So, the payrolls data was exaggerated, but for what purpose? In order to justify rate hikes by the Fed?

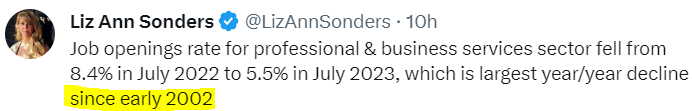

Then we got this:

And this:

I believe it is suffice to say that the employment data is unreliable at best.

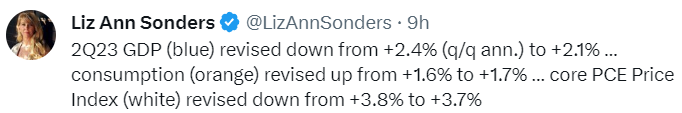

And if that were not enough, GDP and inflation data are also revised down:

Why did statisticians get these important data points so wrong? That’s a discussion for another day, but it has three primary effects: first, the data cannot be trusted; second, it means that the economy is in much worse shape than we were led to believe; and third, the Fed is out of ammunition for another rate hike.

Markets across the board responded as expected. Stocks jumped, the dollar dumped, as did yields, and metals, miners, and bitcoin soared:

Data Manipulation and Its Effects on Gold and Silver

Looking forward, we have both the ISM Manufacturing data on Friday and the normally market-moving Non-Farm Payrolls. I say “normally” because will anyone but the algorithms believe the data?

With rate hikes seemingly off the table for now, what could stop gold and silver going higher, the dollar falling further, and yields too?

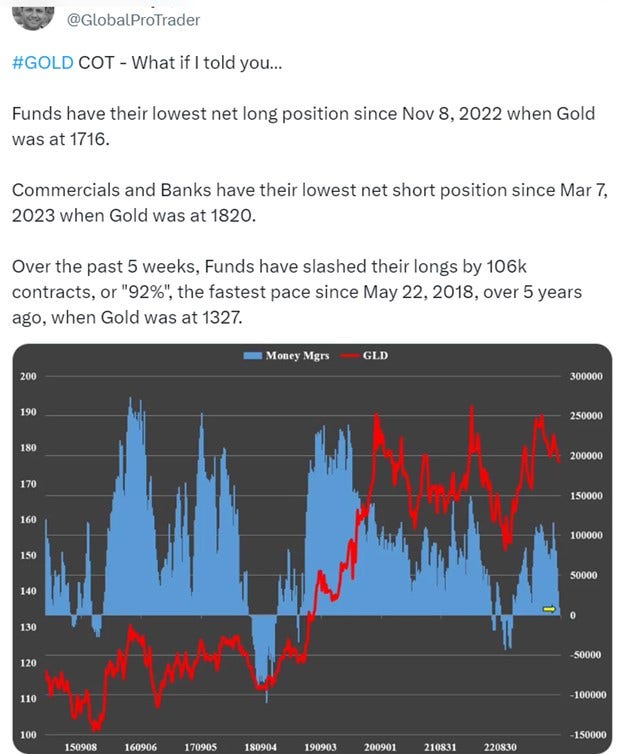

The most recent COT data for gold showed the following:

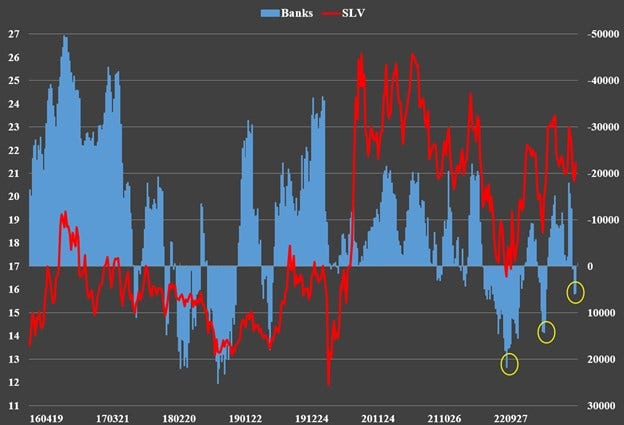

This is bullish to say the least. In silver, the banks remain LONG too:

Suffice it to say that everything is looking good for both gold and silver right now, but until we take out 2011 in gold, I remain cautiously optimistic.

Bullish:

Bearish:

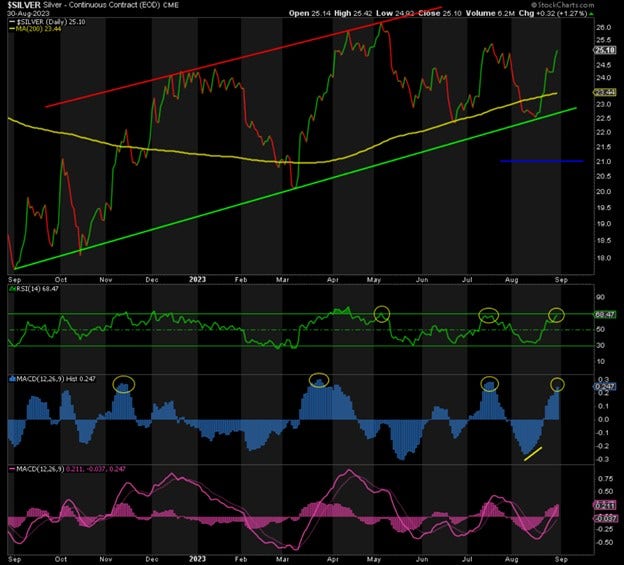

Markers to Watch for Silver

Silver is overbought here on multiple indicators. A pullback looks likely in the short term, but will it be brief and then continue higher again? Or will it break the 200D MA and, more importantly, the rising channel since it bottomed in September last year?

Conclusion: Precious Metals Trajectory

I’m long both metals and miners, but I remain cautious. That said, if we do go back down, I expect that to be the low once and for all before we finally head higher.

Did you know you can get the Sprott Money Monthly Wrap Ups, Ask The Expert,

special promotions and insightful blog posts sent right to your inbox?

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.