An easily-predictable short squeeze has lifted COMEX precious metal prices off their recent floor. Equally predictable is the current rush to proclaim that new highs for 2024 will soon be forthcoming.

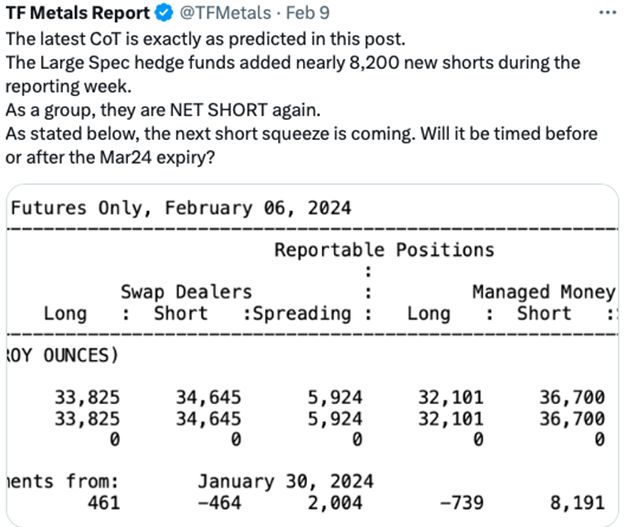

Let's start with the latest Spec short squeeze. How can I say it was easily predictable? Below are X posts from yours truly on February 6 with follow up on February 9:

The hedge fund short selling continued through Tuesday, February 13, when price fell 61¢ on the day while total COMEX silver contract open interest rose by 5,800 contracts. At that point, the stage was set for a short squeeze and price rallied $1.31 from Wednesday, the 14th, through Friday, the 16th.

But the reaction to this has been predictable too. Precious metal stackers and traders are so desperate for a breakout that most are prone to proclaim a new bull market to all-time highs any time a short-term low has been reached. Now please don't get me wrong—I'm desperate for that breakout too. However, a small short squeeze of some overzealous, computer-driven hedge funds does not mean that COMEX silver is about to break over $28.

I've tried to warn you, my dear reader, of my 2024 expectations on several occasions this year, and it's still only February! If you missed my annual macrocast, here again is the link:

Please read it, but if you're short of time, I'll cut to the chase: I'm just not looking for huge gains this year. Next year? YES! This year? I think we should be content with something closer to what has been "average" so far this century.

I could be wrong, of course, and there are myriad events that could compel Jerome Powell and his Fed to cut rates sooner and more aggressively than expected. Failing that, though, COMEX gold and silver will likely trade sideways for most of the year as the "market" waits for monetary policy changes.

And you can see this on the charts below too. Let's start with the gold price. As 2023 ended, the spot gold price finished a month above $2000 for the first time EVER when it closed at $2036 on November 30, 2023. It then proceeded to close above $2000 at month end for December and January too. On a weekly basis, spot gold has closed above $2000 for thirteen consecutive weeks! This is all unprecedented, and it bodes very well for the long-term price trend.

Again, though, spending all of this time above $2000 does not mean that price is headed to $3000 by July. Instead, look at the long-term chart below. After reaching $1900 in 2011, price then spent the better part of eight years below $1800. Only in 2020 did it finally breech that level, and it has spent the three years since consolidating and preparing for the next leg higher.

When can we feel confident and almost certain that the next leg upward has begun? Spot gold needs a monthly close above $2070 before anyone should begin to get excited. Beyond that, a monthly close above the $2120 intramonth high of December last year and it's on.

In the meantime, gold remains rangebound regardless of how hard you and I might cheer it on. For me, the proper strategy is to continue adding physical on price dips while I wait for the inevitable breakout.

You can see this in silver too. All of us who have held physical silver for over a decade are patiently awaiting the next bull market. When will it begin? When price breaks out above $28. Until then, a wise investor will simply continue to add physical metal on price dips like last week. Simply put, if the bullion bank trading desks are getting net long at $22 silver, maybe you should consider that level as a floor for your dip-buying too.

The chart below is quite clear. The breakout above $28 is coming. Of that you can be certain. But check the timing. Does it appear to you that you should expect this breakout before late summer or autumn of this year? In fact, I don't think we should expect it before next year. In the meantime, you'll certainly be warned if you follow the chart. Price will not break into the $30s until it breaks above $28—and it's not getting to $28 until it clears $26. Just keep these levels in mind, and if you do, the inevitable breakout rally will not catch you by surprise.

In conclusion, please remain patient. Much higher precious metal prices are coming. However, if you get all excited every time prices move higher for three or four days in a row, you're likely to get frustrated and then possibly miss out when the breakout finally arrives.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.