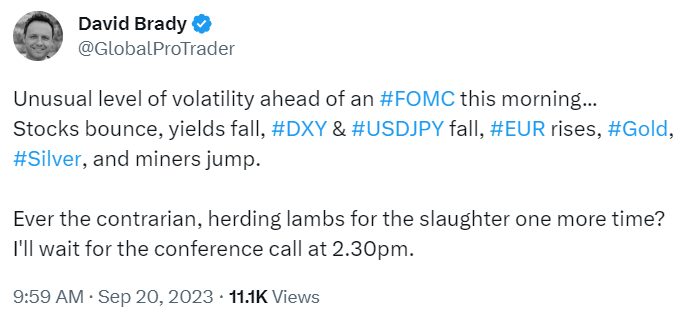

The Fed did nothing today except to say that they foresee one more rate hike before the end of the year and that’s it. The Fed also forecast rate cuts later in 2024. While this weighed on the dollar and yields, this was supportive of gold and silver prices before and after the announcement. But my mantra is “Never trust the first move!” when it comes to the FOMC:

Precious Metals Market Reaction

The markets didn’t disappoint…

All of the losses in the DXY since Sept 14 were erased, and then some. The gains in both gold and silver were virtually wiped out at the end of the day. This despite relatively positive news for precious metals and miners. Interest rate hikes are done, or we have just one more to come, then cuts to look forward to.

Key Takeaways for Precious Metals

What does this mean for gold and silver going forward? Nothing has changed from my perspective. The risk remains that we see 106 in DXY before it heads south, and a higher or lower low in both metals next, signaling the final bottom. My preferred target remains 22-21 in silver. As long as gold remains above 1900, I’m focused solely on the massive upside ahead.

Today’s peaks at 1968 in gold and 23.88 in silver are now the new resistance levels to focus on. Once we take those out, the probability that we test the highs at 2089 in gold and 30 in silver next go up dramatically. It’s not a matter of if, but when, IMHO.

Did you know you can get the Sprott Money Monthly Wrap Ups, Ask The Expert,

special promotions and insightful blog posts sent right to your inbox?

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.