Did you know you can get the Sprott Money Monthly Wrap Ups, Ask The Expert,

special promotions and insightful blog posts sent right to your inbox?

Sign up to the Sprott Money Newsletter here.

We just wrote about copper four weeks ago, but you might have missed it. And since the mainstream financial media is starting to catch on, now would seem a good time to write about it again.

Let's start with that article from last month. If you missed it and want to get up-to-speed on the story, you might start by clicking this link:

Over the past four weeks, copper prices have risen and fallen backward, much like COMEX gold and silver. As the Fed continues to raise interest rates in the first few months of this year, the key driver of the copper price may actually be the U.S. dollar index. In short, when the dollar index rises, copper falls and vice versa.

However, as 2023 progresses, we are likely to see fundamental factors such as physical supply and demand have a greater impact on price. And what are some of those fundamental factors?

- Ever-increasing demand as a battery metal

- Chinese demand returning after three years of "Zero Covid" lockdowns

- Rapidly falling global stockpiles

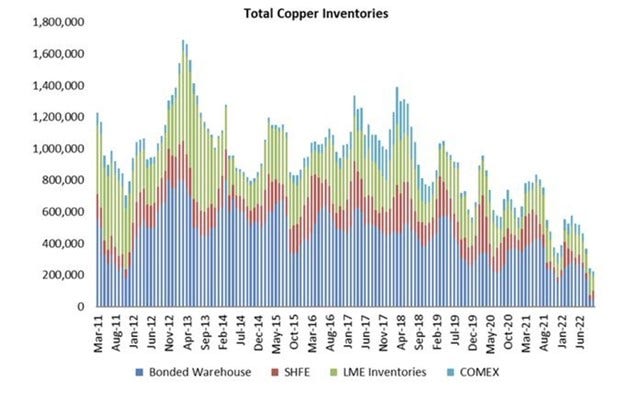

Oooohh ... that last point is a big one. Taken that post last month, have another look at this chart of global physical copper stockpiles and be sure to note the ongoing depletion. That's a drop of about 80% over the past five years!

And the mainstream financial media is beginning to take notice:

- Metals prices could spike with markets so tight, Trafigura says

- Trafigura plans to take large amounts of LME copper -sources

- Silver, Copper Prices On The Rise Amid Supply Shortages

- Miners Are Caught Between Rocks and Hard Places

- There isn’t enough copper in the world — and the shortage could last till 2030

OK, so now let's check the chart. What do we see below? Though off its recent highs, copper is back into its consolidation or "flag" area that has been the predominant price range since 2020:

You should be certain to note that the last time copper broke out and moved higher out of a long-term price range, it rallied about 70% on the back of a weaker dollar and renewed QE. If you believe as I do that another period of a weaker dollar and renewed QE is pending for later this year and next, what's to stop copper from rallying in the same manner as before? If you add 70% to the breakout level of $4.80, you get a price target of $8.20 ... and that doesn't even consider all of that global physical stockpile depletion. As such, could the next move in copper lead to double digit prices? You bet it could.

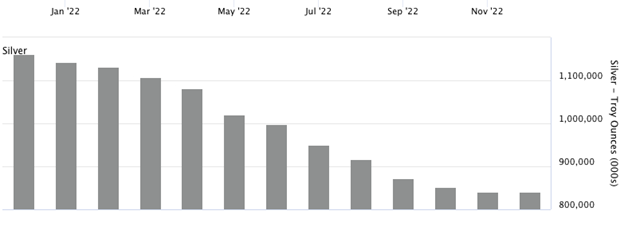

So now let's draw this back to the precious metals and, in particular, silver. As you know, silver is also a very important industrial metal and conductor of energy in the so-called "green revolution". Also, like copper, physical silver is also being depleted globally:

And if you think the entire 800,000 ounces listed is freely available for delivery, think again. See this from Ronan Manly at BullionStar:

But even outside of that, just check the long-term correlation between copper and silver. If you think there's a chance that the copper price does break out later this year, then you should probably be expecting higher silver prices too. In fact, you might say that silver is already rather deeply undervalued versus copper!

So we'll keep a close eye on copper in the months to come. If it's about to double in price from here, it's not a bad investment on its own! However, what a soaring copper price might do to the silver price is something we should all keep in mind as 2023 progresses.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.