With the recent felony convictions of several J.P. Morgan traders, including their one-time head of precious metals trading, Michael Nowak, some have concluded that COMEX price manipulation has ended. No way. Not a chance. There's too much easy money to be made.

As I've observed COMEX precious metal trading over the past thirteen years, I've seen price management and manipulation nearly every day. Sometimes the manipulation is more covert, like the price swings that surround the twice-daily London Fixes. Sometimes the manipulation is more overt, like the battle to avoid a weekly close above $2000 that we saw two weeks ago, culminating with a Friday close of $1,999.90.

Most of the time, prices are manipulated to the downside, but I've seen prices manipulated to the upside too. In general, the direction of the manipulation depends upon speculator and hedge fund positioning. If the funds are heavily net long (meaning The Banks are heavily net short), price is managed and then manipulated downward. The opposite is true on the rare occasions when the funds are net short either COMEX gold or COMEX silver. In those periods, you're apt to see sharp short squeezes where price is manipulated higher against the trading funds. Here's a link to a post where we discussed precious metals prices a few months ago.

But daily/weekly management of their books is not the only goal of the bullion bank trading desks. Many of these same firms act as "market makers" in the option markets. As such, whenever a set of options are due to expire, you can almost always count on some deliberate and overt price manipulation. You can see this action around COMEX option expiration days (the next one is Monday, November 27, by the way), and we've written about it often. Here's another link to review COMEX Options Update from last April.

However, the third Friday of every month brings expiration of listed options too. What are those? I'm referring to options on mining shares and the big ETFs—the GLD and the SLV. At expiration, if there are a considerable number of puts or calls that can profitably be excluded from finishing "in the money", you can be sure that you'll see some COMEX precious metal price manipulation.

One Such Event Occurred Last Friday, November 17

On that day, COMEX gold and silver prices were working on a fourth consecutive day of higher prices, a trend that had moved nearly 100,000 GLD and SLV call options to near "in the money" status. When the week began, the GLD was trading near $180 with the SLV just north of $20. However, as trading began on Friday—option expiration day—the GLD share price had moved above $184 with the SLV approaching $22.

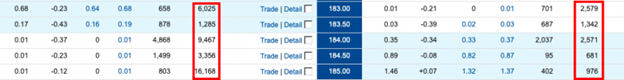

With those prices in mind, take a look at the option open interest as Friday's trading began. The totals for calls and puts are highlighted in red boxes. First, note the wide disparity between the number of open calls versus open puts. Next, notice how many additional calls would finish in the money and with a cash settlement if price was to rally again on Friday and finish the NYSE session north of $185. Doing the math, that's 28,991 open call options between $184.00 and $185.00. If the GLD price closed on Friday at $185.50, those options would have been cash settled for $2,554,050.

And the stage was set for a rally on Friday too. As the day began, bonds were trading slightly higher and the U.S. Dollar Index was down 20¢ on its way to a half point total loss on the day.

COMEX Gold Price

Under these conditions, you should always expect some sort of rally in the COMEX gold price. But not on Friday and not on NYSE option expiration day. Instead, as you can see below, gold was trading at $1994 and already up $8 when the COMEX session began (at 07:20 on the chart below). It was immediately set upon by aggressive selling that drove it backward to $1982 just ninety minutes later. It then traded mostly sideways for the remainder of the day, even as the dollar index continued to fall.

As such, the share price of the GLD fell, too, finishing the day down 2¢ at $183.67. Of course, this placed over 4,000 puts into the money at expiration, but for The Banks, that's just the cost of doing business when you're rigging 7X that amount of calls out of the money.

You can see this, too, in COMEX silver and the SLV. The manipulation here was even more egregious last Friday as a falling dollar index almost ALWAYS leads to higher silver prices during the COMEX session. Just not on NYSE expiration day.

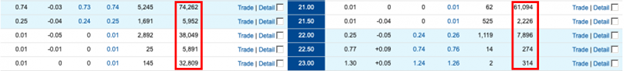

Below is Friday's open interest chart for the SLV. Price hit $22.06 on Thursday before closing at $21.76. If the share price of the SLV had closed Friday above $22, there would have been over 38,000 calls with a strike price of $22 that would have finished in the money. A closing price above $22.50 would have benefited 5,891 more.

But look at what happened instead. Even with that sharply falling dollar index, the silver price was driven backward nearly 2% in the first 90 minutes of COMEX trading and then held sideways for the remainder of the day. As such, the SLV was held in check, too, and instead of rallying, it closed unchanged on the day at $21.75.

COMEX Silver Price

Doing the math, if COMEX silver had rallied as you might have expected on any other Friday, you might have seen the SLV close at, say, $22.40. At that price, every one of those 38,049 $22 calls would have finished 40¢ in the money and the cash settlement cost would have been $1,521,960. Instead, they expired worthless.

As with the GLD puts that were moved into the money, the rigging in silver placed 7,896 $22 puts into the money by 25¢. However, that settlement cost of $197,400 is paltry and, again, seven times less than the cost might have been for an "in the money" call settlement.

Conclusion on Precious Metals Prices

In the end, what's the point of this week's post? I guess there are three.

- COMEX precious metal price manipulation continues, regardless of therecent felony convictions of several bullion bank traders.

- If you understand point #1, then you'll better understand the day-to-day price fluctuations and maybe even use them to your advantage in the stacking of actual, physical metal.

- Please do not forget that the next COMEX option expiration day is slated for Monday, November 27. Both silver and gold have front-month contracts expiring soon, and as such, silver and gold prices are likely to see significant "shenanigans" over the next few days.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.