While I’m not sure that the bottom is in place yet, especially in silver, let me show you why I believe it is close.

The Correlation of 10-Year Yield to Gold and Silver Price

The yield on the 10-Year Treasury Bond is highly correlated to gold, which in turn is highly correlated to silver. The relationship is inverted, meaning that when yields rise, gold and silver tend to fall, and vice-versa for falling yields.

The weekly chart above shows that the 10-Year yield is making negatively divergent higher highs across all indicators. It’s now on its second negatively divergent higher high. This typically means that the next big move is down.

The daily chart shows more or less the same negative divergences on both the RSI and the MACD histogram, with a peak in place on the MACD line. Now this doesn’t rule out another negatively divergent higher high, but it also suggests that the next direction is lower.

The fact that the 10-Year is in a Bear Flag pattern adds weight to the argument that lower yields are coming, which is supportive of higher gold and silver prices.

If that were not enough, the monthly chart agrees also:

Multiple negative divergences yet again, with a long way to fall for the RSI and the MACD line. The MACD histogram is already ahead of the game. It looks like a date with 2% handle is on the cards, based on the 200-month moving average.

Furthermore, the Banks remain massively long bonds, in anticipation of lower yields.

Simply put, it looks like yields are topping out here, and lower yields typically mean higher gold and silver prices. They also tend to mean a lower DXY.

DXY and Its Impact on Gold and Silver

The dollar index, or DXY, is also inversely correlated to gold and silver prices. It will be difficult for the DXY to rise much further if the 10-Year Bond yield heads south.

Previous peaks in the DXY have coincided with overbought RSI readings on the weekly chart. At ~60, DXY has room to go higher. But resistance at 106 stands in the way.

Although the DXY continues to climb on a daily basis, the RSI has been capped at around 70, which means overbought and negatively divergent, and the MACD histogram is clearly falling and therefore also negatively divergent. At the same time, the MACD line is at a level consistent with recent peaks in the DXY.

While the DXY has room to move higher on the weekly chart, negative divergences are piling up, and sentiment in the dollar is extremely bullish. This is at the same time that the 10-Year yield is looking toppy. All of this suggests that the DXY is running out of runway, and the odds favor it turning down very soon.

The combination of falling yields and a falling DXY would be bullish for gold and silver should this scenario play out in the coming days or weeks at most.

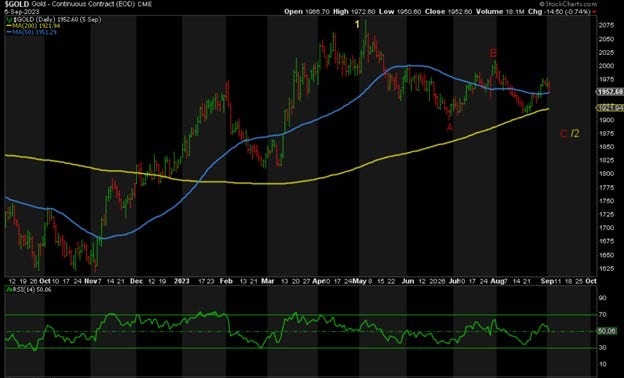

Gold Outlook

Gold remains relatively resilient. As long as it remains above 1900, I’m only looking up. But a break of 1900 would mean at least 1875, or worst case, closer to 1800.

Silver Outlook

Like gold, but to a greater extent, silver remains under pressure from higher yields and a rising DXY. My preferred scenario is that it breaks the 200D MA and the green support trendline dating back to the bottom in September 2022. This would ensure maximum bearishness and provide us with the final low that acts as the launching pad to $30 plus next. That lower low would be somewhere between 22-21, worst case 20.75, IMHO.

Did you know you can get the Sprott Money Monthly Wrap Ups, Ask The Expert,

special promotions and insightful blog posts sent right to your inbox?

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.