Did you know you can get the Sprott Money Monthly Wrap Ups, Ask The Expert,

special promotions and insightful blog posts sent right to your inbox?

Sign up to the Sprott Money Newsletter here.

1. Central Banks are loading up. “Follow the Smart Money.”

2. With Central Bank Digital Currencies, aka CBDCs, on tap, physical Gold and Silver are the only safe harbor for the coming inflation. Government spending and Central Bank printing that is not invested in production, agriculture, or service business, creates nothing of value. Instead, it just adds more currency chasing fewer goods and services – the definition of inflation.

3. Although I doubt the BRICS countries will launch a BRICS currency pegged to Gold at their meeting on August 22nd, they will likely officially state their plan to do so. In other words, it’s coming and it’s only a question of when. The dollar is already struggling, as it is backed by nothing more than the backing of the U.S. government, a country drowning in trillions upon trillions of debt. A gold-pegged currency backed by a massive bloc of countries like BRICS could be a death blow to the global reserve currency – just not yet.

4. Higher mortgage rates are already weighing on homeowners. What do you think will happen if they go even higher as inflation resurges? Commercial real estate is already in recession, with properties selling for 40-60% of costs. Stocks are becoming increasingly overvalued, driven by short-squeezes, speculation, and aided by a weaker dollar. It’s only a matter of time before they succumb to gravity. The point being, the only tangible assets that will hold their value and, more likely, increase it in the coming maelstrom are Gold and Silver. The central banks know this.

5. If we get another banking crisis, which is very possible, it will make the previous crisis just a preview and the next one will be the main event. What happened to Gold and Silver the first time around? They soared as depositors withdrew their money to safer locations, such as precious metals. Imagine how high they could go the next time around.

6. If the risk of World War III does increase dramatically, whether it’s centered around Ukraine or Taiwan, or a retaliation against the introduction of the BRICS currency, physical Gold and Silver are your only safe harbor imho.

7. The Fed says it plans to raise rates by 0.25% two more times. The July FOMC hike is already priced, but the September hike has a probability of less than 20%. Now, there is a lot of time between now and September, and that probability may increase depending on the data, but if it does happen, it is likely to be the last. Gold and Silver know this. “Peak rates” means they can only go down thereafter, even if they stay “higher for longer”. Said differently, the worst-case is already priced in.

8. Gold and Silver have bottomed imho, following extreme oversold and bearish sentiment. This is just my humble opinion, but I believe Gold will break its all-time-high of 2089 soon, and that the next peak will be closer to 3000 than 2000, far in excess of the prior peak. I also believe that Silver will substantially outperform Gold as it did in the previous rallies from 1974-1980 and 2000-2011.

9. The only caveat is that the inevitable crash in stocks comes sooner rather than later. My best guess is October, traditionally the worst month for stocks in terms of crashes. Gold and Silver likely go down with the ship “initially”, but just like in October 2008, they will anticipate the reversal of the Fed and other central banks around the world to rate cuts and QE. We all know what that means for precious metals.

DXY

This is the weekly chart for dollar index, or “DXY”. It has broken 100 and now it’s rebounding to ~102.

Having reviewed all of the major peaks and troughs in DXY going back to 1980, all the troughs are more or less identical. They are characterized by extreme oversold conditions across the RSI and both MACDs, or we see positively divergent lower lows, or a mix of both. The most important of the 3 indicators is the MACD Line at the bottom in magenta. The MACD Line is the principal authority on when the DXY peaks and troughs. But for added confirmation, in every case over the past 40 years or so, a major low is followed by a higher low and a higher high.

Why am I sharing this? Because although the RSI and the MACDs are all positively divergent here, we don’t have a higher low and a higher high in price. Simply put, they could all go a lot lower before this correction is over. The MACD Line in particular has room to run before reaching the levels at the lows in 2021 and 2018.

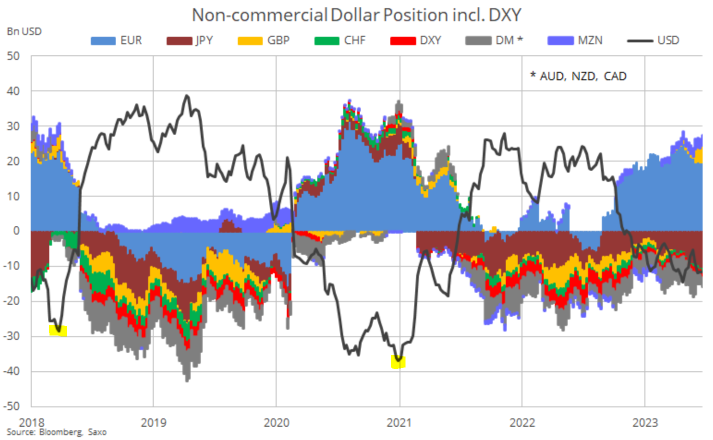

The exact same goes for positioning in the dollar, courtesy of @Ole_S_Hansen:

If the inverse relationship between the DXY and Gold continues, and DXY continues south, then Gold, and especially Silver, have a lot higher to go yet.

Although sentiment in the dollar is falling, it is still moderately bullish. This just means that it could fall a whole lot more before it becomes extreme bearish, another signal that the low is in. If this plays out, again, this is bullish for Gold and Silver.

My primary target in DXY on the downside is ~92 based on a classic A-B-C correction from the peak of ~114.

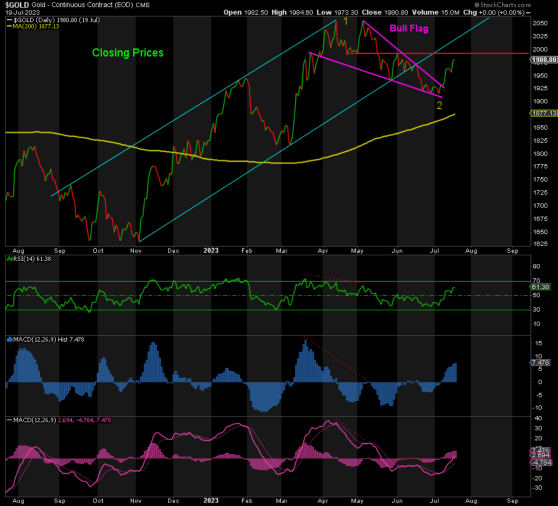

GOLD

Gold has broken out of a Bull Flag formation to the upside. 2000 is key resistance. 1890 is critical support. The RSI and both MACDs are trending upwards. The MACD Line has just crossed the zero line to the upside and has plenty of runway ahead before becoming extreme overbought.

2000 is the key. If we break that and close above it, then the fourth test of the all-time-high is likely the last ‘test’ and we break through, with 2350-2400 to come next.

SILVER

Silver held the 200-day moving average and thereafter broken resistance at ~24.40. The problem now is that it is becoming extreme overbought based on both the RSI and the MACD H in blue. However, I expect any correction to be relatively mild to work off that overbought condition somewhat before heading higher again. The MACD Line can clearly go higher before it reaches the peak in the MACD Line at 26.23, and perhaps even higher than that. The weekly RSI at 59 also allows for further gains before becoming extreme overbought.

Positioning is near as ideal as can be in Silver. Sentiment is coming off extreme bearish levels, which reinforces my bullish outlook.

Short-term pullbacks aside, I expect Silver to break the Feb 2021 peak of 30.35 next.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.