Today, I am looking at the bullish and bearish cases for gold and silver. While both have rebounded off the recent lows, the risk of a lower low has diminished, but it is certainly not zero. However, I believe the risk to the downside pales in comparison to the pending rally ahead.

The Bullish Case for Gold

As previously stated in prior articles, unless 1900 is broken to the downside, the rally to new highs remains intact.

Wave 2 on the chart above was a near-perfect 38.2% retracement of the Wave 1 rally from 1618 to 2085. This is a standard Wave 2 correction. If so, the following Waves were Wave i and ii of Wave 3. Next comes the big money Wave, iii of 3, to the upside, breaking 2085 and setting a new record high on the way to ~2400 next.

Sentiment is rising from its most bearish levels since it bottomed in November. A bullish signal.

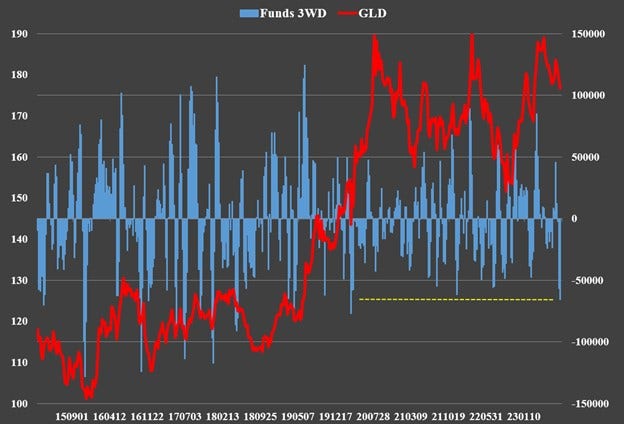

Positioning shows that the so-called dumb money, the hedge funds, are racing to get short at the fastest pace since March 2020. We all know what happened next back then. Another bullish signal.

At the same time, the banks, or the smart money, are slashing their shorts in order to get long.

The 10-Year Bond Yield may have already peaked, and the DXY and USD/JPY along with it.

If true, and it remains to be seen, this is also extremely bullish for gold and silver.

The fundamentals also support the bullish thesis:

- The return of masks in anticipation of a new COVID variant. Could this be a prelude to lockdowns? The last time those occurred, the government had to respond with massive fiscal spending and the Fed was forced to slash interest rates and ramp up QE into the trillions. Gold and silver soared! Are the metals anticipating a similar scenario?

- Another COVID-led crisis would also provide cover for another Fed 180 and ditch their anti-inflation policy to support the banking sector, stocks, and real estate.

- Then there is BRICS, which is expanding its membership and is openly promoting the end of the dollar in trade settlements. They are also considering a new BRICS currency, backed by gold and other commodities, which would rival the dollar’s status as the global reserve currency. The petrodollar is also on shaky ground.

All of which is likely to benefit gold and silver.

In summary, there are plenty of reasons to believe that the monetary metals are going higher from here. The first step to confirming that would be the break of the recent high at 2011 and, most importantly, the record high at 2089.

The Bearish Case for Gold

An alternative count for gold would be that Wave 2 has not been completed yet, and a bigger ABC Wave is playing out. A 50% retracement of the entire Wave 1 rally would target ~1850 on the downside for the bottom of Wave C and completion of Wave 2. Worst case is 1780, where Wave C = A*1.618.

We do have a low higher in place at ‘B,’ but it will take a break of ‘A’ on the downside for a lower low to turn the trend down and confirm the bigger Wave 2 is under way. This is why 1900 is so important for both scenarios.

We don’t have confirmation that the peak is in for bond yields or the DXY yet either.

Saving the best for last, we’ve got the Jackson Hole conference on Friday, where both Fed Chair Powell and ECB head Lagarde are speaking. If on balance, they are hawkish, we could see gold and silver head back down to lower lows. If dovish, then up the metals go.

Silver’s Parallel Journey

All of the same factors that affect gold obviously impact silver too, so I won’t repeat them.

Silver has rebounded extremely well from its lows, but it is unlikely to be able to soar to new heights if gold is heading in the opposite direction.

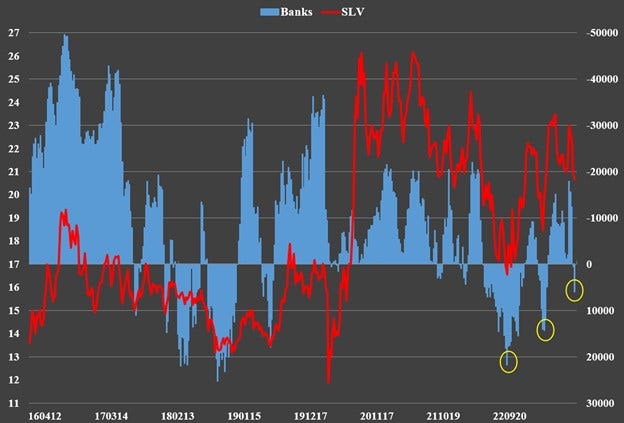

However, there is one big difference between the two that suggests silver will outperform gold going forward, positioning.

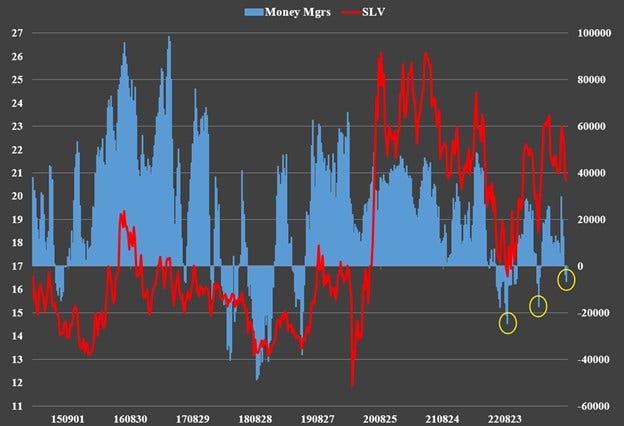

The funds are net SHORT!

While they could get even more short, this strongly suggests that the low has been struck or we have one more lower low to come, worst case ~21 IMHO.

Meanwhile, the banks are net LONG.

Again, while the banks could even increase their net long position, it is a very bullish indicator for silver.

GDX Influenced by Performance of Gold and Stocks

A quick word on the miners… While they track the metals, they could underperform the metals in the short term if we get renewed downside in stocks in the short term. The S&P could still fall further to my target of ~4200. From my perspective, this just makes them cheaper to buy, because when the metals rally, the miners will outperform them dramatically in my opinion, especially some individual miners.

Conclusion: Risk-Reward Skewed to the Upside in Precious Metals

The balance of data in hand suggests the risk-reward is skewed to the upside, but the risk of a lower low remains in both the metals and miners, especially if 1900 in gold is broken. Jackson Hole could be the trigger. That said, at the risk of repeating myself, beyond the very short term, the upside from here is $750 to $1050 in gold compared to a risk of $100 to $170 on the downside. The same goes for silver, a risk of $3 to the downside compared to a potential reward of $25 to $40. Both are a no-brainer from my perspective!

Did you know you can get the Sprott Money Monthly Wrap Ups, Ask The Expert,

special promotions and insightful blog posts sent right to your inbox?

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.