July 30, 2020

We got the anticipated pullback in Gold right on schedule the night before the FOMC meeting on Wednesday. It dropped from a high of 1975 to support at 1900. Given Silver’s dramatic outperformance relative to Gold, it was no surprise that the dump in Silver was far more precipitous. Silver fell ~15% between 10pm Tuesday and 3am Wednesday morning. That’s equivalent to a drop of ~500 points in the S&P from 3200 to 2700, “in just five hours”. Black Monday type moves.

While the pullback played out as expected, with Gold breaking its 2011 peak and then falling back, the key question is whether or not we drop even further or are we already done on the downside and heading even higher?

The FOMC meeting yesterday was a big nothing-burger. The Fed extended its numerous facilities to the end of the year—no surprise there—and said that they stood ready to increase liquidity depending on how the coronavirus develops and its effect on the economy. The Fed Put is now official policy: More waves of infections equals more money printing. Gold and Silver figured this out in March and have taken off ever since. But all uptrends are defined by higher highs and “higher lows”. While we have already seen a sharp drop in both Gold and Silver, the likelihood that this is all we get is low. Don’t be surprised if we get at least one more leg down before higher again. So, what are the levels to watch on the downside before we explode higher again?

GOLD

Given the break of the 2011 peak at 1923 and the subsequent drop back to 1900 before rebounding again, 1900 is clearly a nice round support level now. Another test of this level is a high probability, imho.

The most recent leg of this rally to a new all-time-high kicked off once we held support at 1790 and broke resistance at 1830. This makes 1825 and 1790 support levels to watch for should we break below 1900.

Gold has been in a rising wedge pattern since the start of the year, and the bottom of that wedge is currently around 1830 and rising. If we break that, then 1825 and 1790 need to hold to confirm a false breakout to the downside, then up we go again. Through 1790 and then 1750 must hold to avoid a deeper dive.

At this point, given the strength of the uptrend and the fact that Gold buyers are clearly focused on the bigger picture of money printing and the growing risk of hyperstagflation, we need to focus on support levels for dips and assume they will hold until broken. A strategy of buying the dip near these levels by adding a position and placing a stop below each support level or simply averaging in given the long-term outlook makes sense in this environment, but how you invest in this bull market is up to you.

Technical indicators remain extreme overbought, sentiment is still euphoric, and the banks remain significantly short. That said, we must respect the trend until the trend is broken and focus on the support levels that, if broken, suggest a change in trend. At the risk of stating the obvious, unless they are broken, they are buying opportunities.

Only a break of 1670 followed by a lower high <1975 suggests a major trend change. This is highly unlikely at present and only increases in probability if we break 1750, imho. At the same time, the risk remains that Gold goes sideways to down over the next couple of months and corrects the extremities outlined above, but beyond that, I am only looking up to even higher highs. This is buy-the-dip bull market, imho.

A few quick words on the DXY and real yields given their near perfect inverse correlations to Gold and that the currency and bond markets make Gold look like a rain drop in the ocean.

DXY

However you want to count this move down in DXY and whether or not we have completed 5 waves down in wave 3 or C, we’re due a bounce in the dollar here, imho. If the correlations hold and the dollar does get a decent bounce, this will weigh on Gold and Silver “in the short-term”.

My view for years has been that the Fed print dollars on steroids to support stocks and cap bond yields and that the dollar would be the sacrificial lamb. Even though I foresee a bounce next, I expect the dollar to continue falling thereafter to lower lows. This means that beyond the very short term, Gold and Silver are going much higher, imho.

REAL YIELDS

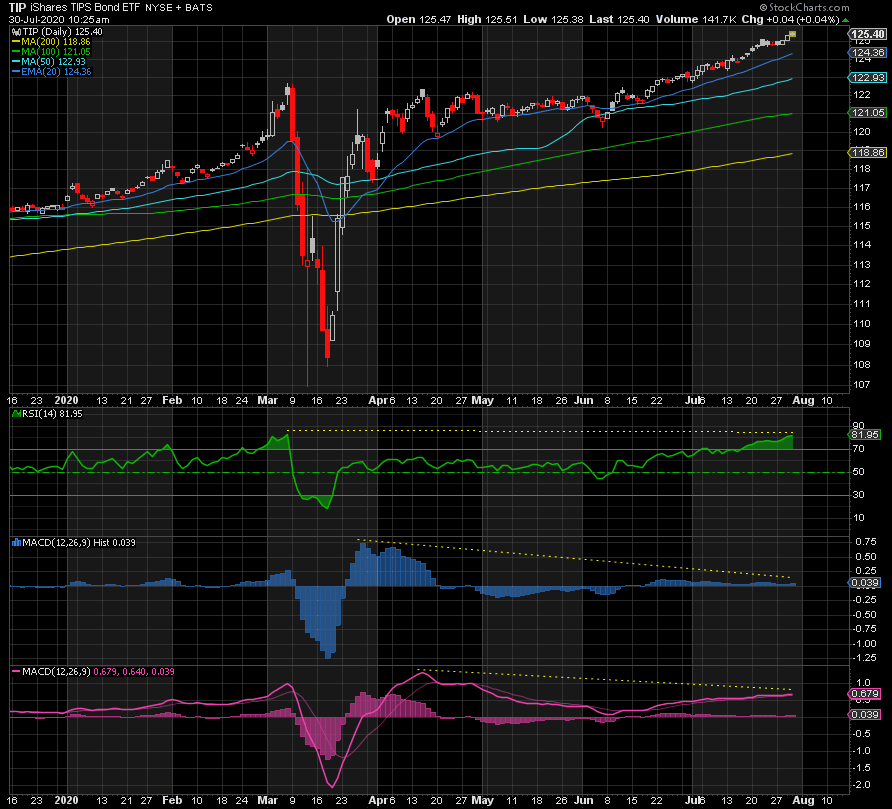

The price of Treasury Inflation Protected Securities, or “TIPS”, are the inverse of real yields. As TIPS rise, real yields fall. TIPS are near perfectly correlated to Gold and real yields are near perfectly inverse correlated to Gold.

The charts below show TIPS hitting new highs and real yields hitting new lows. The 5-year real yield has fallen to -1.2%, a gift for Gold.

5-Year real yield courtesy of Quandl.com:

TIPS:

While real yields could continue to fall and TIPS continue to rise, if their near perfect correlation to Gold holds, then any bounce in real yields and pullback in TIPS will weigh on the metal.

So what could cause a bounce in the DXY and real yields? Using March as an obvious example or the period from March to October 2008, a sharp drop in stocks, however unlikely it seems right now, would likely be the trigger.

S&P 500

The momentum behind this stock market rally since March is clearly petering out. A close below support at 3215 and a break of 3200 opens up a move down to 3000 to 2965 or even as far as 2460 to fill the gap left behind down there. As I shared in my forecast back on July 6, if stocks suffer a major reversal over the next coming months, this will likely cause a spike in deflationary fears on top of a rapidly deteriorating economy and a tsunami of bankruptcies. This in turn would cause real yields and the dollar to rebound, imho, and therefore weigh on Gold and Silver. This is worth watching.

SILVER

I couldn’t finish without a word or two on my biggest holding by far, Silver.

As stated above, Silver suffered a violent drop following its euphoric blow-off top. However, it failed to reach the top of the channel it broke out of last week, a channel that it has been in since March. This is now support. Given that I am not a fan of the one drop and done club, I expect Silver to at least test the support currently around 22.10 and rising. Should that hold and we rebound from there, then the possibility of another spike higher becomes very real. However, if we break that support, then we’re back in the channel and the bottom trendline becomes key support to avoid a deeper dive. That support is currently around 19.50 and rising. If 19.50 is broken, well, let’s cross that bridge if and when we come to it.

CONCLUSION

While downside risks remain, most notable being a sharp drop in stocks, the trend in Gold and Silver has been bulletproof to this point. Therefore, unless we break 1900 in Gold and 22 in Silver, the trend must be respected. However, if support is broken and we see a deeper dive, manage your positions, respect your stops, but don’t jump ship altogether because whatever the low is, you are unlikely to see that price ever again. This is a buy-the-dip market. Once the Fed steps back in—and they will, by blowing up their balance sheet—and the U.S. Treasury sends in the currency bombers ahead of the elections in November, Gold, Silver, and the miners, especially the junior Silver miners, will truly explode beyond belief, imho.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.