The relationship between the health of regional banks and commodity prices, including gold and silver, is complex and influenced by various economic, psychological, and market factors. Today’s article explores ongoing issues related to the Federal Reserve rate hikes, the effects of the Fed’s policies on the banking sector, and concerns about the banking sector's stability and subsequent impact on precious metals prices.

The Fall of Silicon Valley Bank

It has been six months since the latest banking crisis claimed the 2nd, 3rd, and 4th largest bank failures in U.S. history. However, the news flow has been pretty quiet since, leading most investors to assume that all is well and that the concerns are behind us.

Let's start by revisiting the events of March-April 2023. On March 7, Fed Chairman Powell appeared before the U.S. Senate banking committee for his semi-annual Humphrey-Hawkins testimony. His prepared remarks are linked below:

If you read through them, you'll notice that there was no mention of any concern over the impacts that his aggressive rate hike policies could be having on the banking sector.

Just three days later, news began to hit that the balance sheet of Silicon Valley Bank was undercapitalized due to losses in its fixed income portfolio. Bank runs move pretty fast in the 21st century, and by Monday, March 12, Silicon Valley Bank failed.

Looking back, you can see the impact of this crisis by reviewing the chart of the KRE, which is a large ETF that holds a portfolio of regional banking shares. Check the rapid collapse from March to May, with the price falling nearly 50% over that time period.

The Fed’s Response to Instability in the Banking Sector

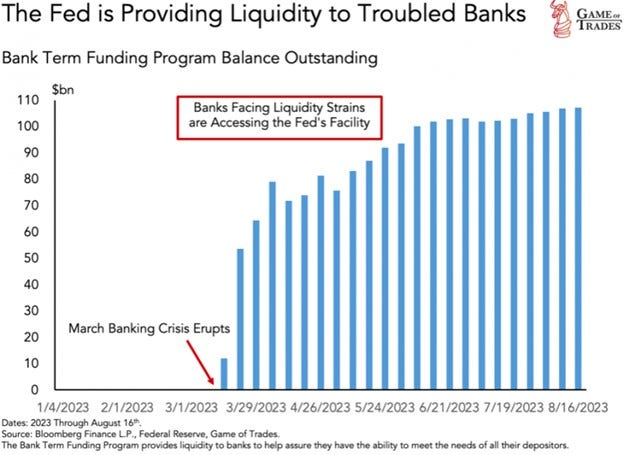

In an attempt to remedy the situation, the Fed sprang into action with another one of their new "alphabet soup" programs. The Bank Term Funding Program (BTFP) was hastily unveiled on March 12, and it provided distressed banks a facility to park some of their underwater fixed income investments. At its core, this new program was/is a place where banks can put their investments to the Fed. Due to higher interest rates, a bond on the bank's books may be trading at 80¢ on the dollar. However, since it is expected to mature at 100¢ on the dollar at some date in the future, a bank can utilize the BTFP to swap the bond for cash today. The bank gets the full credit and, instead, it's the Fed which sits on the bond until maturity.

So that was easy. Problem solved. The Fed can now just keep on hiking and keep rates "higher for longer," right? Right?

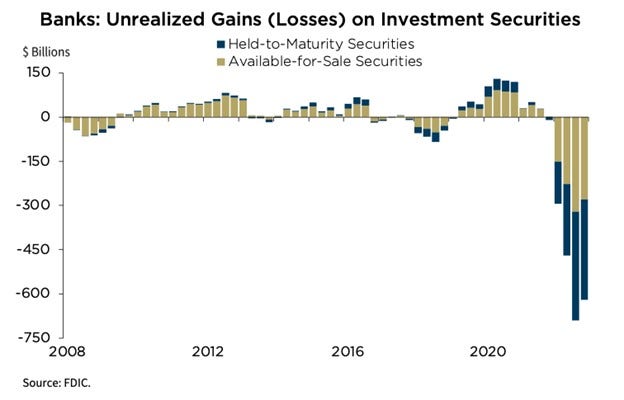

Well, maybe, not so fast. As you can see below in this chart from Myrmikan Research, the continued Fed rate hikes have driven unrealized losses on bank balance sheets to new heights.

And with those growing losses, the amount of securities parked at the Fed's BTFP keeps growing, too:

Understanding How Real Estate Impacts Economic Stability

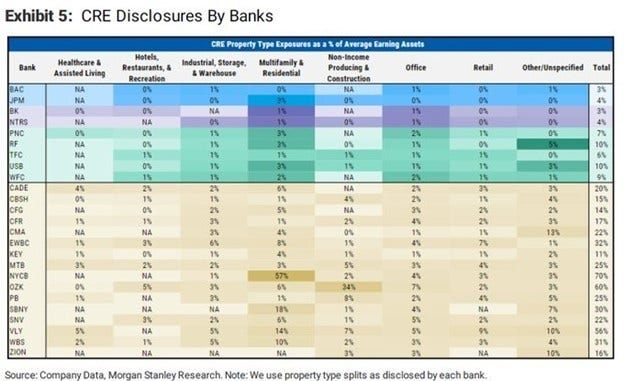

But it's not just the Fed's interest rate hikes that are causing troubles for the regional banks. Many of these banks have significant exposure to the U.S. commercial real estate market. Higher interest rates, combined with post-COVID vacancies and a slowing economy, have created myriad issues for the commercial real estate sector, and many analysts expect a crisis to emerge in the months ahead.

Economic crises can erode confidence in financial institutions, leading investors to question the stability of traditional investments. In such scenarios, investors may opt for tangible assets like gold and silver, which are not tied to the health of financial institutions, providing a sense of security and stability.

And here's a handy chart I found a few months ago that details the portfolio breakdown for many banks involved in the commercial real estate sector.

Assessing the Effectiveness of the Federal Reserve’s Intervention

So, is the regional banking crisis over? Did the Fed fix the problem by creating the BTFP? Again... maybe. However, I'll remind you that on March 7, Chairman Powell seemingly had no idea that Silicon Valley Bank was just three days from imploding. To that end, let's take a current look at the price chart of the regional bank ETF, the KRE. What do we see?

Well, after the relief rally and bounce that followed the March-May decline, the share price appears to be rolling over. Could this be a sign that the financial situation of the regional banks is about to deteriorate again? The area between $40 and $42 appears to be pretty important support. You should be sure to keep an eye on it in the days ahead.

The Ripple Effect on Precious Metals

And why is all of this of importance to gold and silver investors? Because the early stages of the regional banking crisis led to a perception that the Fed would soon be forced to halt and reverse their rate hike scheme. The easing of those banking fears allowed rate hikes to continue through the summer, but renewed concerns would again focus the market's attention on the likelihood of a near-term Fed pivot back toward rate cuts and QE.

As a reminder, recall the price action in COMEX gold during that same March-May timeframe when the financial stability of the regional banks was in question. It was all doom-and-gloom for gold investors in early March. However, price then rallied nearly 12% in just over four weeks. A similar 12% move today would take the COMEX gold price to a new all-time high near $2200.

![]()

In summary, it appears that the liquidity situation for some U.S. banks continues to deteriorate, so please be sure to keep an eye on the regional bank shares in the weeks to come. Unexpected crises may pop up at any time, and the mood of precious metals markets can shift just as fast.

Did you know you can get the Sprott Money Monthly Wrap Ups, Ask The Expert,

special promotions and insightful blog posts sent right to your inbox?

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.