Did you know you can get the Sprott Money Monthly Wrap Ups, Ask The Expert,

special promotions and insightful blog posts sent right to your inbox?

Sign up to the Sprott Money Newsletter here.

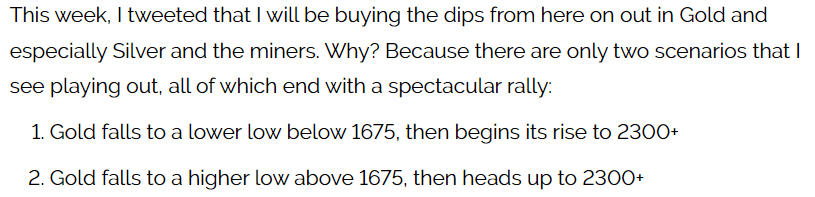

Three weeks ago, I wrote an article entitled “Gold: Two Scenarios, Same Result” where I stated the following:

This still holds true. Which scenario plays out is dependent on how Gold responds to the coming drop in stocks, oil, and bond yields. Either way, we’re heading to 2300+, imho. If it’s scenario 1, I expect many to become disillusioned to the point of capitulation, when they should be considering it a gift beyond measure given what follows.

Despite the fact that the Funds have reduced their net long position by 40% in the past two weeks, they are still holding a net long position that is three times bigger than their net long positions at each of the 1675 lows. This suggests that I may get that ideal positively divergent lower low prior to the rally to new highs (and possibly as far as 18 in Silver), likely in association with the forecasted dump in stocks.

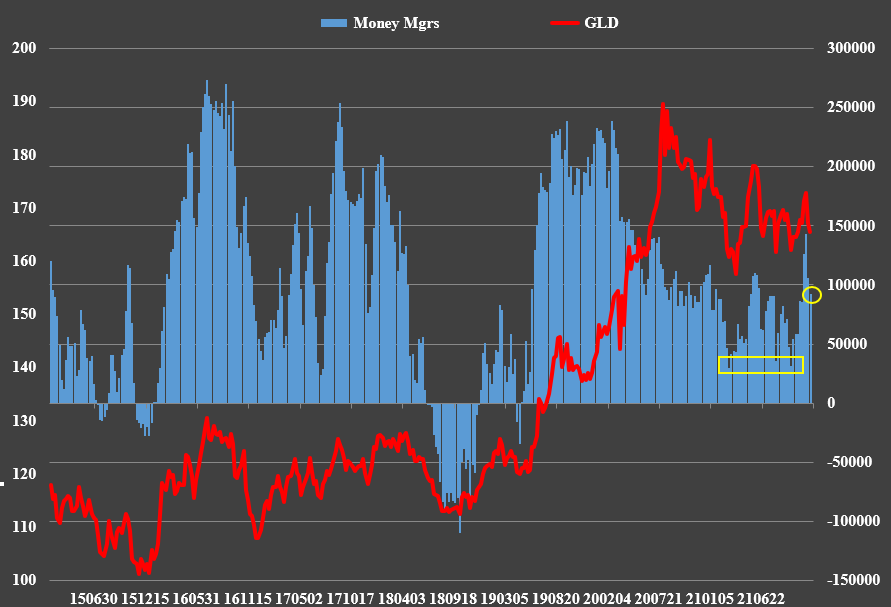

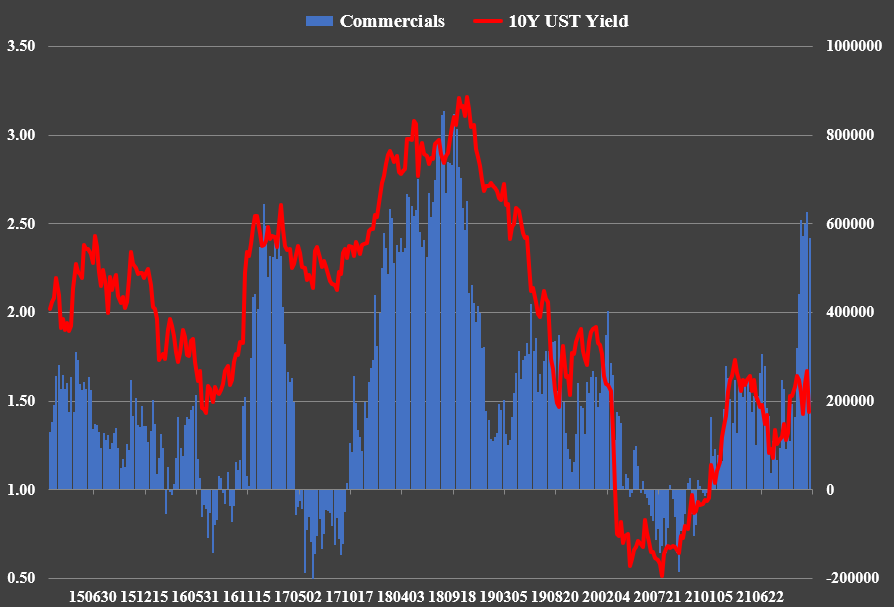

The Banks’ positioning in the 10-Year Treasury Bond market certainly backs up that expectation:

They have raced to the biggest net long position in the 10-Year since 2018. This means that they expect bond prices to rise significantly and yields to dump. This is what happens when stocks crash. Everyone sells stocks and runs to the safety of bonds, driving bond prices higher and yields lower. It’s only a question of when, and based on the speed with which they loaded up long, it’s sooner rather than later.

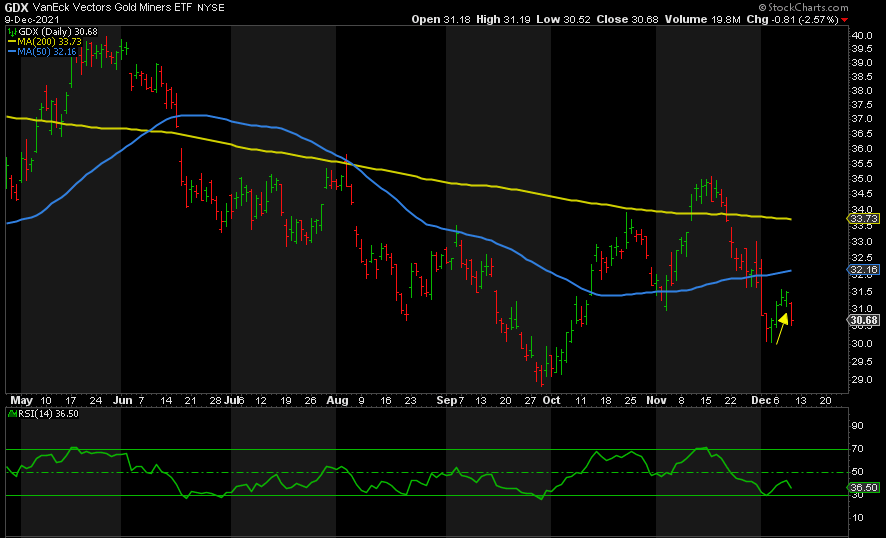

Last week, I wrote an article entitled “Do or Die for Miners” where I stated:

“I’m looking for a bounce here [in GDX] before a positively divergent lower low but higher than the September 29 low of 28.83. Then up we go.”

“Only a break of the prior lows of 28.83 and 11.41 in GDX and SILJ respectively would negate the possibility of a sharp rally higher to follow soon.”

We got the forecasted bounce and now it looks like we’re heading down to that positively divergent lower low or to new lows below 28.83 in September. Should the former play out, expect a sharp rally higher on a break of the recent high at 31.60. If it’s the latter, then 25 is back on the table prior to takeoff.

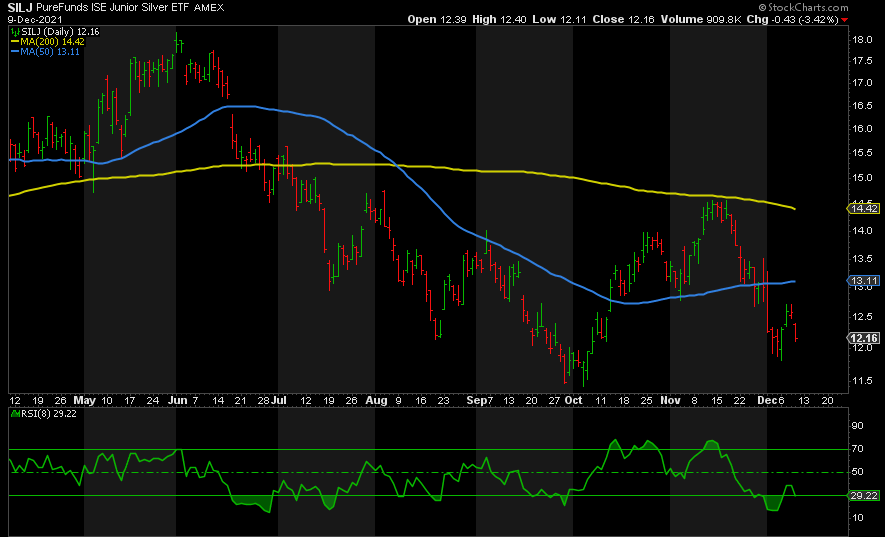

As forecast, we got a similar bounce in SILJ and now we’re heading down to a positively divergent lower low or below the September low of 11.41.

As with GDX, if the former, a break of the recent high of 12.72 suggests a move up to at least the 200-day moving average. Below 11.41 and a move down to 8 is not out of the question.

I also said this two weeks ago:

“I am expecting stocks, oil, and bond yields to rebound imminently, then dump to even lower lows thereafter. The bottom comes when the Fed steps in.”

Part 1 is near complete with stocks, oil, and bond yields all having rebounded significantly. Now it’s just a matter of when Part 2 and 3 begin. My guess is the dump will begin within weeks and the Fed will step in come January or February. That said, I’m less concerned with the timing than I am with projected falls and then recovery to new highs ahead. The same goes for Gold and Silver. It’s only a question of when and where they bottom before the rally to 2300+ begins, imho.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.