In recent market updates, we've been closely monitoring the trends in both silver and gold. Today, we'll discuss the current state of precious metals prices and what to expect in the near future.

Quick Recap of Recent Precious Metals Data

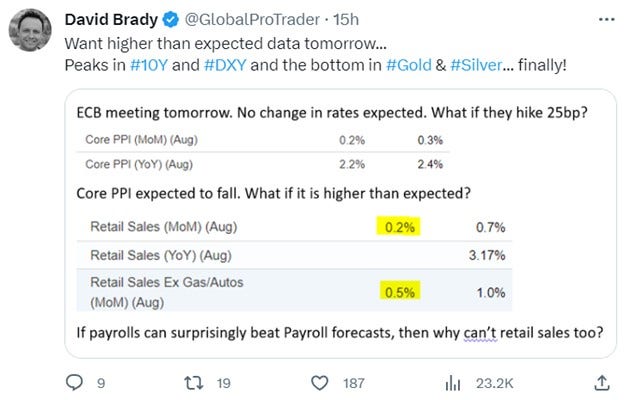

Yesterday, I shared the following on X:

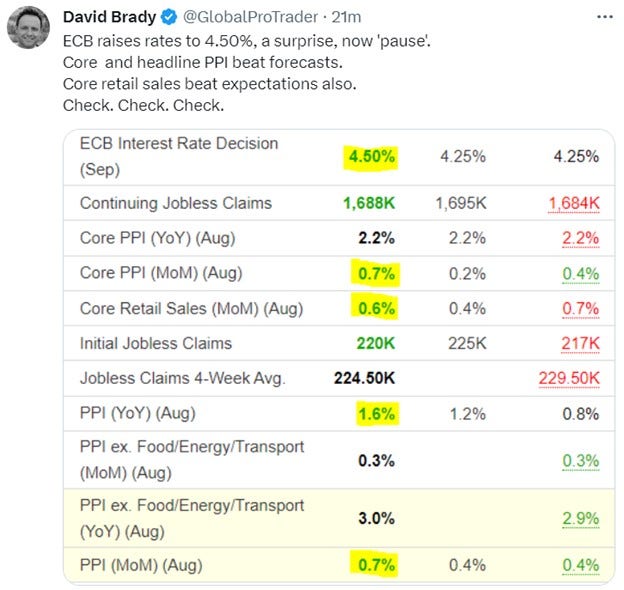

This morning:

Silver dropped to 22.65 following the data, but it’s already rebounding now…

Silver Price Movement

I am not sure if this is the low or not. I still prefer a double bottom at 22.14 or ideally a lower low in the 21 area. That said, for those with zero physical silver, this is a good place to start adding some.

Gold Price Outlook

Gold hit 1922 this morning and is now rebounding. Could still see 1915, 1900, 1875, or worst case 1850.

The big picture remains the same for both metals:

Silver Analysis

Stated last week in the article Peak Yields and DXY to Signal Lows in Gold and Silver:

“My preferred scenario is that it breaks the 200D MA (done) and the green support trendline dating back to the bottom in September 2022. This would ensure maximum bearishness and provide us with the final low that acts as the launching pad to $30 plus next. That lower low would be somewhere between 22-21, worst case 20.75, IMHO.”

Gold Analysis

I’ve been saying this for weeks now because nothing has changed: “As long as it remains above 1900, I’m only looking up. But a break of 1900 would mean at least 1875, or worst case, closer to 1800.”

Conclusion: Approaching Lows for Silver and Gold

The lows are close, we’re just waiting for maximum bearishness and a catalyst to cause a peak in yields and the DXY and the bottom in the metals. It could be anything, a renewed banking crisis, there are so many potential triggers. In the meantime, I would recommend buying some physical metals at this stage. While we will likely go a little lower, the risk-reward from here is ridiculously skewed to the upside, IMHO.

Did you know you can get the Sprott Money Monthly Wrap Ups, Ask The Expert,

special promotions and insightful blog posts sent right to your inbox?

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.