Three weeks ago, we issued a "Crash Watch" for the global equity markets. Though the indices have traded sideways and October is almost over, the Crash Watch remains in effect and equity investors should remain on the lookout for volatility and possible Crash Warnings.

If you missed the original post from three weeks ago, here's the link:

In summary, a Crash Watch is issued when conditions become favorable for a sharp drop in equities. The ingredients are there, but they've yet to come together to create an actual crash. It's a bit like the image below:

And what ingredients are currently present?

- very high nominal rates compared to the recent history of central banks’ ZIRP

- a looming economic recession in the U.S. that threatens corporate profits

- trouble in the banking sector via high interest rates and commercial real estate losses

- increasing drain of liquidity toward money market funds

- forced unwind of hyper leverage in bond market

- end of Japanese yen "carry trade" as Bank of Japan gets squeezed by higher rates

To that final bullet point, the following from Alasdair Macleod. Few people understand how important the yen carry trade is to global liquidity:

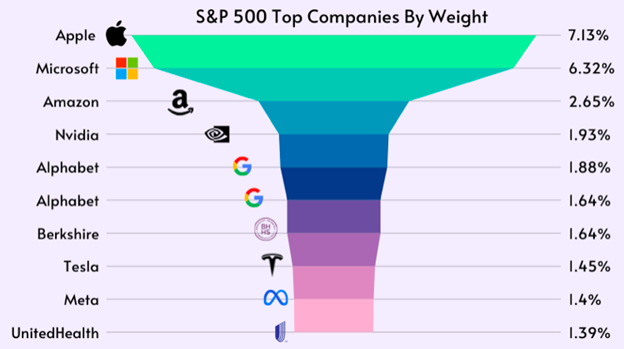

So we remain on Crash Watch. As such, let's check the chart of the S&P 500. But first, keep in mind that this index is not equally weighted with all 500 stocks getting a 0.2% allocation. Instead, it's heavily loaded on the top end, and this allows just a handful of stocks to have a disproportionate impact on the index as a whole.

Regardless of the weighting, on the chart below you can see that the S&P 500 index remains perilously close to taking out some important support levels. If that happens, the stampede to the exits might cause the Crash Watch to be upgraded to a Crash Warning.

On the daily chart, note that the index is in a downtrend and below its 50-day moving average. As I type this on Monday, the 23rd, it seems to be desperately trying to hold its 200-day moving average too. Watch this level very closely in the days ahead.

Should the 200-day and the 4200 level fail to hold as support, the door opens for a much deeper decline. How far? The weekly chart would seem to indicate that test of 4000, and the trendline from the Covid lows would be next, and below there, 3600 or even lower.

And why does this matter to gold and silver investors? History has taught us that the U.S. Federal Reserve takes stock market performance into account as it adjusts its monetary policy. So long as stocks remain elevated, the Fed believes it can keep interest rates high. If/when stocks begin to plummet, a rapid policy shift from tightening to easing will inevitably follow.

So keep an eye on stocks and watch this space. The current Crash Watch may soon be adjusted to a Crash Warning. If that happens, we'll be sure to let you know.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.