Rallies off the lows:

GOLD: 1824 – 1975, or 8.3%.

SILVER: 20.85 – 23.49, 12.7%.

GDX: 25.62 – 30.07, 17.4%.

Such gains present us with three scenarios:

1. Prices continue higher.

2. A pullback to a higher low.

3. A pullback to a lower low.

Now let’s use some charts to analyze each potential outcome.

Gold Prices

The weekly chart shows that we have broken out to the upside. But fake breakouts can be extremely bearish.

Furthermore, the daily chart shows that Gold is becoming extreme overbought on both the RSI and MACD Histogram.

While Gold broke resistance at 1970, it did not close above there. If we close above 1970 in the next few days, then wave i of (3) of 5 is not done yet. Scenario 1 is playing out.

However, if we have seen the peak in wave i, then wave ii down has begun. A standard A-B-C correction would target 1944, a higher low. If wave C = 1.618*A, then the target is 1929. Again, a higher low. Then up we go in wave iii of (3) of 5. If that is the case, look out for a spectacular rally that’s far bigger than wave (1).

Now for the worst-case scenario…If we fall below 1929, then the risk of a new lower low, below 1824, rises dramatically. This would signal that wave (2) has not been completed yet and we will have to wait for the next wave i-ii count before takeoff.

That may be a lot of jargon for many, so allow me to simplify it. Either Gold continues higher, or we drop to 1944 or 1929 prior to blastoff, or we break 1929 and we are heading back down to the 1800s or lower.

How do we know which scenario is playing out? If Gold is continuing higher, it should close above 1970 for at least a couple of days. If wave ii down is under way, we bottom at or anywhere above 1929 and then close above 1970. If the worst-case scenario has begun, we break and close below 1929, and then below 1900 to be sure.

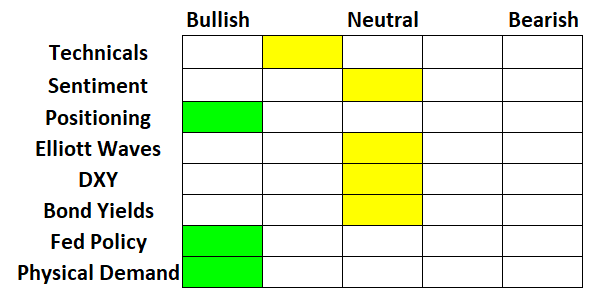

My ‘FIPEST’ summary illustrates how inconclusive the metals and miners are here:

Sentiment has turned moderately bullish, imho, but perhaps we have come too far too fast, which would support a short-term reversal.

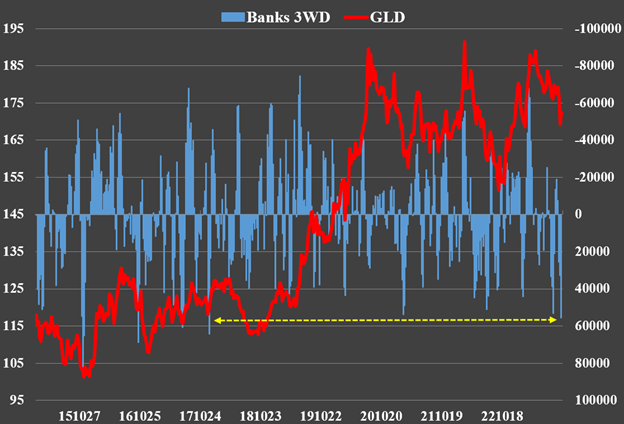

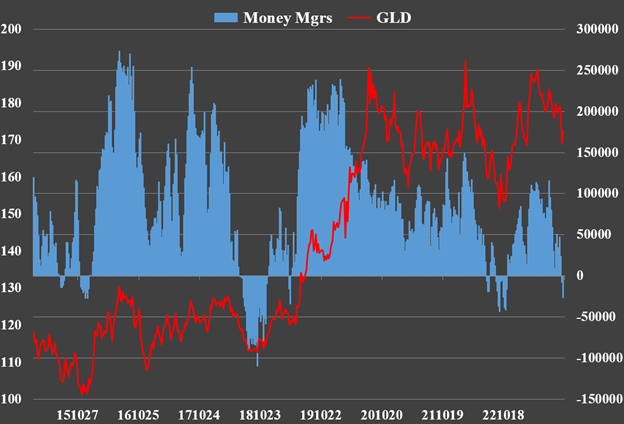

Positioning has turned bullish recently as Banks race to cut their short positions and Funds are now short.

The DXY and Bond Yields could go either way in the short-term, but they’re both approaching a peak, imho, if they haven’t already topped out.

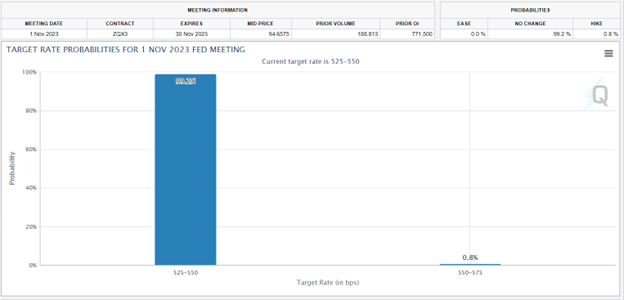

With regard to Fed Policy, there is basically zero chance of a rate hike in November, which is bullish.

Silver Prices

As forecast last week, Silver slammed into a confluence of resistance at 23.50 today and closed at 23.10. The combination of the 200-day moving average and the lower “closing” trendline were too much for Silver to overcome.

A break of 23.50, followed by 24, would signal the bottom is in and we’re off to the races. But if it turns down tomorrow, we could see a higher low of 22.50 or 22.10 then head higher again. However, if we break 22.10, the risk of new lower lows below 20.85 increases in probability.

GDX

The same parameters apply to GDX as they do for Gold and Silver. GDX broke the downtrend since its peak in May but not only fell short of the prior high of 30.13, it closed down on the day. If a correction has begun, my targets for a higher low are 28.85 or 28.36. The latter would provide a backtest of the aforementioned downtrend line and set up GDX for a break of 30.13 next in wave iii of (3). However, a break below 28.36 would increase the probability of a lower low below 25.62.

Two high-beta mining stocks that I follow closely, MUX and HMY, got hammered today, adding weight to the reversal thesis.

Conclusion on Gold and Silver Prices

While I remain extremely bullish over the next few weeks, months, and into next year, we have had a good run off the lows and a short-term reversal would be healthy. However, if we break the lower support levels I provided above, then we may have to wait a little longer for new highs. Either way, wave iii of (3) promises to be spectacular. It’s inevitable, imho.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.