It has been a grueling five-month downtrend for COMEX gold and silver prices, and the charts suggest that, once again, prices are at an inflection point and near a breakout. Can both metals rally and extend from here or is this just another lower high amidst the downtrend?

The first thing to understand about this current bounce in price is that it is due, in part, to a safe-haven bid given the ongoing and worsening hostilities in the Middle East. Rallies in price based upon geopolitical stress are often short-lived and rarely do they have staying power. Understand this first and foremost before we proceed.

However, this current bounce in price is not entirely based upon geopolitics. There are two other important factors in play that are driving prices higher and, as such, give hope that the current downtrends may finally be broken.

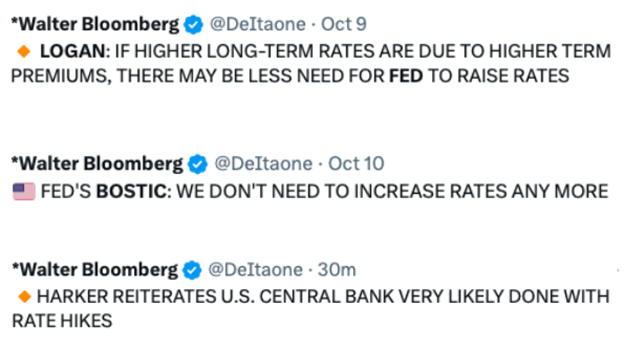

First, the past ten days have brought a change in perception regarding the future of fed funds rate hikes. Following the September FOMC meeting, it was generally accepted that the Fed was set to hike the fed funds rate one more time in 2023 before pausing and holding into 2024. This led to a sharp selloff in both COMEX metals as gold fell for nine consecutive days in late September, for a total loss of about $140. Over the same period, COMEX silver fell, too, for a loss of $2.80.

Last week, however, the tone of the "Fed speak" began to change due to geopolitics and a string of economic datapoints that indicated that the U.S. economy had continued to slow. As such, the fed funds futures market is beginning to predict that there will be no more rate hikes, and the timing of the first fed funds rate cut has been moved forward as well.

Between the geopolitics and the shift in tone from the Fed, there's reason to believe that this current move higher is not just a bounce. Instead, it may be the trend change we've been waiting for since prices first began heading south back in May.

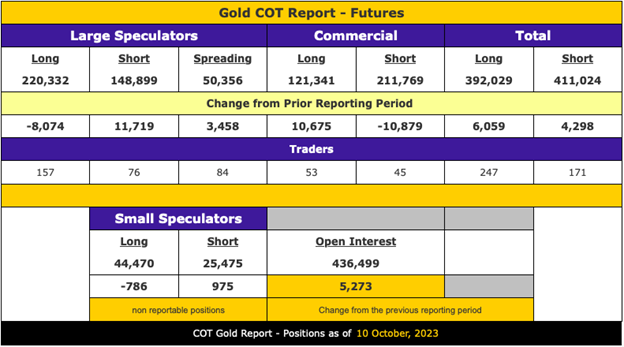

But there's one more item that suggests the lows are in and that the trend toward higher prices has begun. If you're a follower of the COMEX precious metals markets, you likely already know a thing or two about market positioning. Just watch the weekly Commitment of Traders (CoT) reports long enough and you'll notice that price peaks often follow periods where the speculating hedge funds have moved heavily net long. Conversely, price lows often follow periods where these same funds reduce their net long positions or even move net short.

The most recent Commitment of Traders report was surveyed on Tuesday, October 10 and released last Friday, October 13. What did it reveal? Over the course of the reporting week, the Large Speculators (hedge and trading funds) in COMEX gold had reduced their net long position to just 71,433 contracts. At first glance, that may seem like a lot, but back in early May and before this current downtrend began, these same Large Speculators were net long 195,814 contracts. Doing the math, the downtrend in price has already reduced this Large Spec position by about 63%.

Additionally, at 71,433 contracts, the Large Speculators currently hold their smallest net long position since the price lows of December 2018 and November 2022. What price moves followed those net positioning lows? COMEX gold rallied nearly 40% in the first eight months of 2019 and 30% in the first five months of 2023.

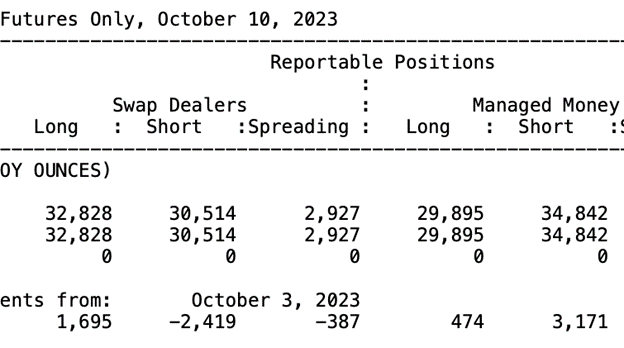

The positioning in COMEX silver is also conducive to an extended rally and short squeeze. As we've written on multiple occasions over the past twelve months, when the hedge funds move net short in COMEX silver, it's only a matter of time before the "swap-dealing" Banks, which are subsequently net long, tighten the screws and force a Spec short squeeze. As of last week, it's clear that the stage is set for another squeeze. Heck, this most recent survey is from last Tuesday, and the squeeze has already begun with price rallying nearly $1.00 last Friday alone!

Again, on the chart above and as of Tuesday, the 10th, The Banks were net long 2,314 COMEX silver contracts while the speculating hedge funds were net short 4,947.

So, let's bring all this together and attempt some sort of cohesive conclusion...

COMEX precious metal prices have been in a downtrend since May 5 of this year. That's over five months! This downtrend may continue, but all downtrends, like all uptrends, eventually end. The safe-haven bid from geopolitics, combined with the shift in Fed sentiment and CoT positioning has given us a chance to finally break the current trend. So, how will we know the trend has shifted? Follow the charts.

For Dec23 COMEX gold, you can see that price is trying to move above its trendline and the 50-day moving average as well. Should it hold these levels—and then extend above the previous bounce highs of $1970-1980—it will be safe to assume that the trend has shifted.

Dec23 COMEX silver has more work to do before we can feel that a new uptrend has begun. However, if gold moves higher, silver will too. Any move above the 50-day moving average should lead to a test of the trendline and, once above the line, the area near $25.50-26.00.

Perhaps the most optimistic chart is that of the big gold mining share ETF—the GDX. As you can see below, it is mirroring gold with a move above its trendline and 50-day moving average. Any move from here that takes price back into the $30s will finally paint a higher high on the chart and officially bring an end to the downtrend.

In conclusion, there are many signals that suggest that the months-long downtrend in precious metal and mining share prices is finally drawing to a close. Though we can't yet say unequivocally that the trend is now higher, we're getting awfully close. As such, if you've been waiting to add to your stacks of physical metal, you might not want to wait much longer.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.