The Complete Guide to Investing in Silver for Beginners

Many people are looking for new ways to earn money. If this sounds like you, then you might be interested in investing in silver. But where do you start? Why should you invest in silver?

The right silver investment strategy can help you earn a good return. Read on to learn why and how you should start investing in silver right now.

Why You Should Invest in Silver

Silver has many investment risks and rewards to consider. Just like the stock market, its price goes up and down. Here are three reasons why people choose to invest in silver.

1. Good for Beginning Investors. To start with, silver costs less than other precious metals such as gold or platinum. This makes it a good place for beginning investors to start. It means that there is less risk involved in investing in silver than gold or platinum. Gold and platinum are rarer and usually more sought after. This drives their prices to be higher than silver. But silver prices rise and fall just as much as gold and platinum prices do. So, if you wanted to invest in precious metals for the first time, then silver is a good place to start. There are many ways to do it, so you don't necessarily need to commit to a method that you've done no research on before. But if your investment is lower and less risky, then what about your rewards?

2. Profits. Investors often choose silver and gold for their perceived higher value, assuming they can yield greater profits. However, this is a misconception. Precious metal prices fluctuate independently, meaning your profit depends on these price changes. Silver can experience more significant fluctuations than gold or platinum due to its varying popularity, potentially resulting in higher profits. In essence, you can achieve a better return on investment in silver compared to gold by monitoring its market value and its fluctuations before investing.

3. Secure Value. In the past, every dollar bill printed was reinforced by a certain amount of gold or silver that was either in the possession of the government or the banks. This is what gave the dollar bill its value. This is no longer the case. The United States uses fiat money now. The dollar bill derives its value not from a tangible asset but from collective societal agreement among Americans. While this fiat money system currently functions smoothly, concerns about its stability persist. Many believe that a society cannot indefinitely rely on fiat money. The solution is to invest in precious metals, which inherently retain value and can be traded for goods even in the event of a dollar collapse. Silver stands out as a popular choice for this purpose.

How To Start Investing in Silver

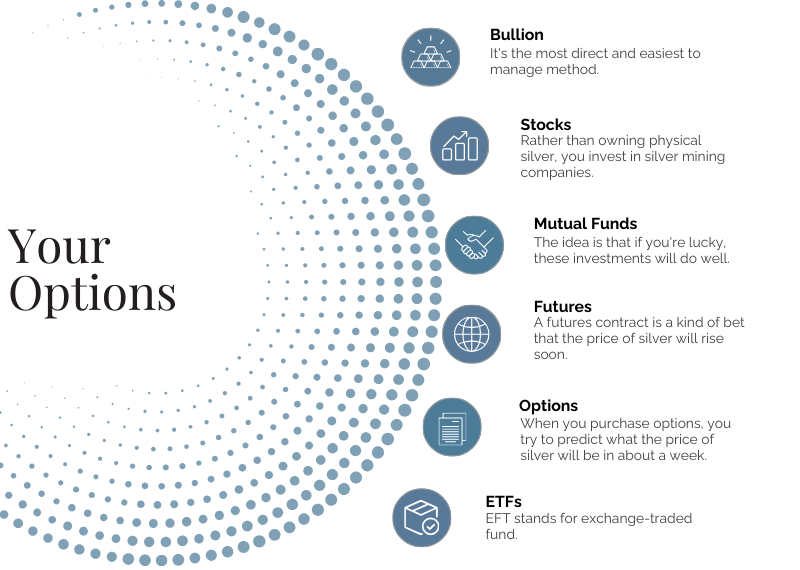

Once you've made the decision to start investing in silver, how do you start? The good news is that there are several great ways to invest in silver.

Bullion

Pros:

One of the more common ways that people invest in silver is with bullion. It's the most direct and easiest to manage method. What this means is that you are buying physical pure silver. This can be either in coins, rounds, or bars. In this case, you own the silver outright. The benefit of this is that no one can contest your ownership of those pieces of silver. You can physically take them anywhere to sell them when you're ready. This ensures that even if something drastic happens, you'll still have this silver in your possession. You can sell it in an emergency or whenever the market price is high.

Cons:

The only caveat to this is that you also need somewhere to store it. Many people choose to get a fireproof safe to protect it from theft or potential damage. Unfortunately, this also means that you need to find a place to store it until you're ready to sell it. This can be a problem if you live in a small house or apartment. Therefore, before you purchase any silver bullion, make sure you know where you're going to keep it until you're ready to sell. If you are looking for a place to safely store your silver, there are options available.

Stocks

Pros:

Another way that you can invest in silver is in the stock market. Rather than owning physical silver, you invest in silver mining companies. The way this works is similar to investing in physical silver. You buy stock in silver companies when prices are low, and then you sell those stocks when the price is high. The benefit of this is that you don't need to store physical silver in your home. All you need to do is watch the stock market.

Cons:

The only caveat to this is that it's hard to predict when stock values are going to change. The people at the highest levels of the company might know that events are about to happen that may affect their stock's value. However, unless they share this information with the public, getting this information is insider trading, which is a federal crime. The good news about that is there are patterns in the stock market. Pay attention to what the company announces to the public and watch how it affects their stock afterward. This will give you an idea of what causes stock values to rise and fall.

Mutual Funds

Pros:

A mutual fund is similar to a joint savings account. The idea is that you and several others put money into a pool together. An investor, known as a Commodity Pool Operator (CPO), then makes investment choices on everyone's behalf. If you're lucky, these investments will do well, and you'll get a profitable return on your investment after a short amount of time. Most of these investments aren't done on the stock exchange and only trade once a day.

Cons:

The only caveat to this method is that it can be hard to determine how much profit you'll actually make.

Futures

Pros:

A futures contract is a kind of bet that the price of silver will rise soon. Purchasing one of these allows you to lock in the current price of silver so you can buy it later at a lower price. This is helpful to anyone who needs silver for any reason but doesn't want to purchase it yet. This could be anyone from jewelry makers to investors. It ensures that they can buy silver at the specified price even if the market value goes up. This also means that you own physical silver that you need to store somewhere. This can be a small issue for some people.

Cons:

The real caveat is the price lock. You might get lucky and end up purchasing the silver when the market is higher than the contract. However, sometimes the market value is lower than the contract price, meaning you might be paying for your silver. This is simply the risk you take when you purchase a futures contract. You just need to keep this in mind when you're ready to purchase your contract and your silver.

Options

Pros:

Silver options are very similar to futures without the locked price. This means your timeframe is much smaller with options compared to futures which are often valid for about five years. It's also a much bigger gamble. When you purchase options, you try to predict what the price of silver will be in about a week. There are two types of options:

- Call options are good for when you think the market price is about to rise. These let you buy silver at your strike price for a specified amount of time. If you were right and the market price rises, then you get to purchase silver at a lower price. If you were wrong and the market price goes down, then you're stuck paying more money.

- Put options are the opposite. These still allow you to purchase silver at your strike price until it expires. However, you want to purchase these options when you think the market price will go down.

Cons:

If the market price increases higher than your strike price, then you lose your premium. You want the market price to stay below your strike price to make a profit in these cases. If you choose to invest this way, you should always be sure to protect your bottom line in case you take a loss.

ETFs

Pros:

EFT stands for exchange-traded fund. They work very similarly to stocks since they're also traded on the stock exchange. However, they have more perks with them than stocks alone. Silver exchange-traded funds include a variety of assets such as bonds, stocks, and physical commodities, so you don't need to sell all of these assets at once. You can sell them in smaller unit pieces when their individual prices are higher. This is one of the safer investment options because you aren't, as the saying goes, putting all of your eggs in one basket. If one asset comes up as a loss, the rest of them might still make enough profit to cover it and more. This protects your investment so that you can at least earn some level of a return on investment. If you play your cards right, you can make an excellent profit off of an ETF.

Cons:

However, keep in mind that no investment is without its risks. It's completely possible that all of your ETF's assets will lose their value at some point or other.

Start Investing in Silver Today

If you start investing in silver, you'd be surprised how much you can earn. In some cases, silver investment profits are higher than you would get for investing in gold or platinum.

And one of the best places to start on silver coin investment is right here at Sprott Money. We have some of the best prices on silver bars and coins on the market, so you know you're getting a good value for your investment.

Check out our selections of silver coins today to get started on your investments today.

Don’t miss a golden opportunity.

Now that you’ve gained a deeper understanding about gold, it’s time to browse our selection of gold bars, coins, or exclusive Sprott Gold wafers.

About Sprott Money

Specializing in the sale of bullion, bullion storage and precious metals registered investments, there’s a reason Sprott Money is called “The Most Trusted Name in Precious Metals”.

Since 2008, our customers have trusted us to provide guidance, education, and superior customer service as we help build their holdings in precious metals—no matter the size of the portfolio. Chairman, Eric Sprott, and President, Larisa Sprott, are proud to head up one of the most well-known and reputable precious metal firms in North America. Learn more about Sprott Money.

Learn More

You Might Also Like:

Looks like there are no comments yet.